Thesaurus : Doctrine

► Full Reference: Auteur, "Titre", in M.-A. Frison-Roche (ed.), Compliance Obligation, Journal of Regulation & Compliance (JoRC) and Bruylant, "Compliance & Regulation" Serie, to be published

____

📘read a general presentation of the book, Compliance Obligation, in which this article is published

____

► Summary of the article (done by the Journal of Regulation & Compliance - JoRC): The author takes up the hypothesis of a Compliance Law defined by its Monumental Goals, the realisation of which is entrusted to "crucial operators" and confronts it with Tax Law. The link is particularly effective since these operators possess what governments need in this area: relevant Information.

Going further, Compliance Law can give rise to two types of obligations on the part of these operators, either towards others operators who need to be monitored, corrected or denounced, or towards themselves, when they need to make amends.

In the first part of this contribution, the author shows that Compliance Obligation reproduces the mechanism of a Tax Law which, for large companies, is embroiled in a process of increasing Globalisation. It enables Governments to aspire to the "Monumental Goals" of combating tax optimisation and impoverishing governments, victims of the erosion of the tax base, in the face of the strategies of companies that are more powerful than they are themselves, by using this very power of firms to turn it against them. Companies become the willing or de facto allies of governments, particularly when it comes to recovering tax debts, or assist them in their stated ambition to achieve social justice. In this way, the State "manages" Tax Law by cooperating with companies.

In the second part, the author outlines the contours of this business Compliance Obligation, which is no longer simply a matter of paying tax. Beyond this financial obligation, it is more a question of mastering Information, particularly when multinational companies are subject to specific tax reporting obligations and are required to reveal their tax strategy, presumed to be transparent and coherent within the group : this legal presumption gives rise to obligations to seek information and ensure coherence, since a single tax strategy is not self-evident in a group.

The author emphasises that companies have accepted the principles governing these new compliance obligations and are tending to transform these obligations, particularly Transparency, into a communication strategy, in line with the ESG criteria that have been developed and a desire for fruitful relations with stakeholders. Therefore the tax relations developed by major companies are being extended not only to the tax authorities, but also to NGOs, by incorporating a strong ethical dimension. This is leading to new strategies, particularly in the area of Vigilance.

The author concludes: "A n’en pas douter, l’obligation de compliance existe bel et bien en matière fiscale." ("There is no doubt that the Compliance Obligation does exist in tax matters").

____

🦉This article is available in full text to those registered for Professor Marie-Anne Frison-Roche's courses

________

Thesaurus : Doctrine

► Full Reference: D. Gutmann, "Droit fiscal et obligation de compliance" (Tax Law and Compliance Obligation), in M.-A. Frison-Roche (dir.), L'Obligation de Compliance, Journal of Regulation & Compliance (JoRC) and Dalloz, coll. "Régulations & Compliance", 2024, to be published

____

► English summary of this contribution (done by the Journal of Regulation & Compliance): The author takes up the hypothesis of a Compliance Law defined by its Monumental Goals, the realisation of which is entrusted to "crucial operators" and confronts it with Tax Law. The link is particularly effective since these operators possess what governments need in this area: relevant Information.

Going further, Compliance Law can give rise to two types of obligations on the part of these operators, either towards others operators who need to be monitored, corrected or denounced, or towards themselves, when they need to make amends.

In the first part of this contribution, the author shows that Compliance Obligation reproduces the mechanism of a Tax Law which, for large companies, is embroiled in a process of increasing Globalisation. It enables Governments to aspire to the "Monumental Goals" of combating tax optimisation and impoverishing governments, victims of the erosion of the tax base, in the face of the strategies of companies that are more powerful than they are themselves, by using this very power of firms to turn it against them. Companies become the willing or de facto allies of governments, particularly when it comes to recovering tax debts, or assist them in their stated ambition to achieve social justice. In this way, the State "manages" Tax Law by cooperating with companies.

In the second part, the author outlines the contours of this business Compliance Obligation, which is no longer simply a matter of paying tax. Beyond this financial obligation, it is more a question of mastering Information, particularly when multinational companies are subject to specific tax reporting obligations and are required to reveal their tax strategy, presumed to be transparent and coherent within the group : this legal presumption gives rise to obligations to seek information and ensure coherence, since a single tax strategy is not self-evident in a group.

The author emphasises that companies have accepted the principles governing these new compliance obligations and are tending to transform these obligations, particularly Transparency, into a communication strategy, in line with the ESG criteria that have been developed and a desire for fruitful relations with stakeholders. Therefore the tax relations developed by major companies are being extended not only to the tax authorities, but also to NGOs, by incorporating a strong ethical dimension. This is leading to new strategies, particularly in the area of Vigilance.

The author concludes: "A n’en pas douter, l’obligation de compliance existe bel et bien en matière fiscale." ("There is no doubt that the Compliance Obligation does exist in tax matters").

____

📕read the general presentation of the book, L'obligation de Compliance, in which this contribution is published

________

Conferences

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR. Regulation, Compliance, Law

🌐s'abonner à la Newsletter par vidéos Surplomb, par MAFR

____

► Référence complète : M.-A. Frison-Roche, "Régulation, Compliance et Gouvernance : un équilibre à expliciter pour accroître la solidité de l’espace numérique", in M-A. Frison-Roche & G. Loiseau (dir.), Durabilité de l'Internet : le rôle des opérateurs du système des noms de domaine. Compliance et régulation de l'espace numérique, Journal of Regulation & Compliance (JoRC) et Institut de Recherche Juridique de la Sorbonne (André Tunc - IRJS), Université Paris I-Panthéon-Sorbonne, 21 février 2025.

____

🧮consulter le programme complet de cette manifestation

____

► Résumé de cette conférence :

____

🎥voir aussi la présentation de l'autre intervention faite au cours de ce colloque : Contrôle de la proportionnalité entre contraintes et pouvoirs : exemple de l’impératif technique d’inclusion.

________

June 4, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Surplomb

🌐subscribe to the Newsletter MaFR Droit & Art

____

► Full Reference: P. Bonis & M.-A. Frison-Roche, "Réguler le numérique, ou Sisyphe heureux" (Regulating Digital, or a happy Sisyphus), in P. Bonis & L. Castex (dir.), Compliance et Nouvelles Régulations, Les Annales des Mines, series "Enjeux numériques, June 2025, p.5-7.

____

📝read the article (in French)

____

📗read the table of content of this special issue of Enjeux numérique, Régulation et Compliance (in French), in which this introductory article is published.

____

► English Summary of this article: This introduction to the collective publication on Regulation and Compliance, which aims to bring order to the Digital space, takes up the idea expressed by Camus when he referred to 'happy' Sisyphus, and expresses the idea that Regulation and Compliance are applied to this area with difficulty, relentlessness and failure, with texts constantly being adopted, modified and amplified on all sides, while the Digital Space is constantly changing, and the slope is constantly being climbed again. But this should not be seen as a failure, not even a flaw, because it is in the nature of digital regulation to always place the regulatory apparatus on our shoulders.

This weight is shared by all, by the Authorities of all countries, because there is something common to all and also because there is something specific for each, because the techniques differ and because the visions of the world that the Politicians print in the texts and project in the Digital will always differ. This weight is also shared by companies, which internalise the rules through Compliance mechanisms, making them necessary agents for the efficiency and sustainability of the digital system, but also players in it, in articulation with Internet users in a permanent and unstable articulation with the local to the finest and this global that the Internet has invented.

This presentation opens the series of contributions to the collective publication Régulation et Compliance, which makes up this special issue of Enjeux numériques in Annales des Mines.

____

🌐read also the English presentation of:🕴️Marie-Anne Frison-Roche, 📝Le Droit de la compliance, voie royale pour réguler l'espace numérique (Compliance Law as a Royal Road for regulating the Digital Space)

________

June 4, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Surplomb

🌐subscribe to the Newsletter MaFR Droit & Art

____

► Full Reference: M.-A. Frison-Roche, "Le Droit de la compliance, voie royale pour réguler l'espace numérique" (Compliance Law as a Royal Road for regulating the Digital Space), in P. Bonis et L. Castex (dir.), Compliance et nouvelles régulation, Annales des Mines, coll. "Enjeux numériques", juin 2025, pp.69-77.

► Full Reference: M.-A. Frison-Roche, "Le Droit de la compliance, voie royale pour réguler l'espace numérique" (Compliance Law as a Royal Road for regulating the Digital Space), in P. Bonis et L. Castex (dir.), Compliance et nouvelles régulation, Annales des Mines, coll. "Enjeux numériques", juin 2025, pp.69-77.

____

📝 read the article (in French)

____

🚧This article is underpinned by a English Working Paper in English, with additional technical developments and hypertext links. : Compliance Law as a Royal Road for regulating the Digital Space

____

► English Summary of this article: In order to describe the role of Compliance Law in regulating the digital space and to conclude that this new branch of Law is the 'royal road' to this end, this study proceeds in 6 stages.

Firstly, at first sight and conceptually, there is a gap between the political idea of Regulating and the ideas (freedom and technology as 'law') on which the digital space has been built and is unfolding.

Secondly, in practice, there is such a huge gap between the ordinary methods of Regulatory Law, which are backed by a State, and the organisation of the Digital Space by these economic operators, that are both American and global.

Thirdly, the political claim to civilise the Digital Space remains and is growing, relying on the very strength of the entities capable of realising this ambition, these entities being the crucial digital operators themselves, seized as Ex Ante.

Fourthly, it corresponds to the conception and practice of a new branch of Law, Compliance Law, which should not be confused with "conformity" and which is normatively anchored in its "Monumental Goals".

Fifthly, Compliance Law internalises Monumental Goals in the digital operators which disseminate them through structures and behaviours in the digital space.

Sixthly, through the interweaving of legislation, court rulings and corporate behaviour, the Monumental Goals are given concrete expression, willingly or by force, in ways that can civilise the digital space without undermining the primacy of freedom.

____

May 4, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Overhang

🌐subscribe to the Newsletter MaFR Droit & Art

____

► Full Reference: M.-A. Frison-Roche, Compliance law as a Royal Road for regulating the Digital Space, Working Paper, May 2025

► Full Reference: M.-A. Frison-Roche, Compliance law as a Royal Road for regulating the Digital Space, Working Paper, May 2025

____

📝 This Working Paper is the English basis for an article written in French "Le Droit de la compliance, voie royale pour réguler l'espace numérique", in 📕

____

► Summary of this Working Paper: In order to describe the role of Compliance Law in regulating the digital space and to conclude that this new branch of Law is the 'royal road' to this end, this study proceeds in 6 stages. Firstly, at first sight and conceptually, there is a gap between the political idea of Regulating and the ideas (freedom and technology as 'law') on which the digital space has been built and is unfolding. Secondly, in practice, there is such a huge gap between the ordinary methods of Regulatory Law, which are backed by a State, and the organisation of the Digital Space by these economic operators, that are both American and global. Thirdly, the political claim to civilise the Digital Space remains and is growing, relying on the very strength of the entities capable of realising this ambition, these entities being the crucial digital operators themselves, seized as Ex Ante. Fourthly, it corresponds to the conception and practice of a new branch of Law, Compliance Law, which should not be confused with "conformity" and which is normatively anchored in its "Monumental Goals". Fifthly, Compliance Law internalises Monumental Goals in the digital operators which disseminate them through structures and behaviours in the digital space. Sixthly, through the interweaving of legislation, court rulings and corporate behaviour, the Monumental Goals are given concrete expression, willingly or by force, in ways that can civilise the digital space without undermining the primacy of freedom.

____

🔓read the Working Paper below⤵️

Dec. 20, 2024

MAFR TV : MAFR TV - Overhang

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR. Regulation, Compliance, Law

🌐s'abonner à la Newsletter Surplomb, par MAFR

____

► Référence complète : M.-A. Frison-Roche, "Les contours géographiques de la Compliance", in série de vidéos Surplomb, 20 décembre 2024

____

🌐visionner sur LinkedIn cette vidéo de la série Surplomb

____

____

🎬visionner ci-dessous cette vidéo de la série Surplomb⤵️

____

Surplomp, par mafr

la série de vidéos dédiée à la Régulation, la Compliance et la Vigilance

May 27, 2024

Conferences

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

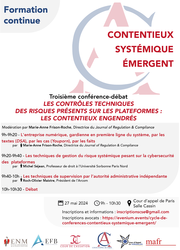

► Full Reference: M.-A. Frison-Roche, "Le Contentieux Systémique Emergent du fait du système numérique ("emerging systemic litigation arising from the digital system"), in Les contrôles techniques des risques présents sur les plateformes et les contentieux engendrés (Technical controls on the risks present on platforms and the disputes that arise), in cycle of conferences-debates "Contentieux Systémique Émergent" ("Emerging Systemic Litigation"), organised on the initiative of the Cour d'appel de Paris (Paris Cour of Appeal), with the Cour de cassation (French Court of cassation), the Cour d'appel de Versailles (Versailles Court of Appeal), the École nationale de la magistrature - ENM (French National School for the Judiciary) and the École de formation des barreaux du ressort de la Cour d'appel de Paris - EFB (Paris Bar School), under the scientific direction of Marie-Anne Frison-Roche, May 27,2024, 9h-10h30, Cour d'appel de Paris, Cassin room

____

🧮see the full programme of this event

____

____

🔲see the slides (in French), basis of this conference

____

🌐read on LinkedIn the summary of this conference les slides

____

🎤read the presentation of the second conference in this manifestation: "Un contentieux systémique in vivo : le cas dit des sites pornographiques" ("a Systemic Litigation in vivo: the case of pornographic prestations platforms")

____

____

____

► Summary of this conference: This speech is a prelude to the three more specific speeches and aims to show how the digital system, by its very nature, produces and will produce "Systemic Litigation".

Systemic Litigation" is defined by "cases" (a procedural notion) brought before judges, who may be judges of first instance, or possibly emergency judges, in which the interests, or even the future, of a system are involved beyond the dispute between the parties.

This Systemic Case may be brought before a specialised judge, including the juridictional body of a Regulatory or Supervisory Authority, but also before a judge of ordinary Law, on the basis of a special text but possibly on the basis of a text of ordinary Law. This can lead to a fragmentation of litigation, even though the unity of the system remains, or even is at stake, in the present and in the future.

The "digital system" is an example of the "natural" production of Systemic Litigation which arise as a result of the Digital System alone, in particular because of the systemic risks inherent in this system, and the fact that their prevention and management are internalised in the operators who have built and manage the system (Compliance Law). The issue is therefore one of Interregulation.

Platforms in particular give rise to Systemic Litigation because of the specific nature of certain risks, for example disinformation, terrorism, destruction of rights (copyright being just one example), the risk of minors having access to content that is destructive for them, and so on.

Digital Systemic Litigation has only just begun.

It is essential that judges are prepared for this and that they face up to it together through dialogue.

________

April 18, 2024

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Surplomb

____

► Full reference: M.-A. Frison-Roche, "L’usage des puissances privées par le droit de la compliance pour servir les droits de l’homme" (Use of private companies by Compliance Law to serve Human Rights) , in J. Andriantsimbazovina (dir.), Puissances privées et droits de l'Homme. Essai d'analyse juridique, Mare Martin, coll. "Horizons européens", 2024, pp. 279-295

____

🚧read the Bilingual Working Paper on which this article is based, with more technical developments, references and hypertext links

____

► English Summary of this article: Following the legal tradition, Law creates a link between power with a legitimate source, the State, public power being its prerogative, while private companies exercise their power only in the shadow of this public power exercised ex ante. The triviality of Economic Law, of which Competition Law is at the heart, consisting of the activity of companies that use their power on markets, relegates the action of the State to the rank of an exception, admissible if the State, which claims to exercise this contrary power, justifies it. The distribution of roles is thus reversed, in that the places are exchanged, but the model of opposition is shared. This model of opposition exhausts the forces of the organisations, which are relegated to being the exception. However, if we want to achieve great ambitions, for example to give concrete reality to human rights beyond the legal system within which the public authorities exercise their normative powers, we must rely on a new branch of Law, remarkable for its pragmatism and the scope of the ambitions, including humanist ambitions, that it embodies: Compliance Law.

Compliance Law is thus the branch of Law which makes the concern for others, concretised by human rights, borne by the entities in a position to satisfy it, that is to say the systemic entities, of which the large companies are the direct subjects of law (I). The result is a new division between Public Authorities, legitimate to formulate the Monumental Goal of protecting human beings, and private organisations, which adjust to this according to the type of human rights and the means put in place to preserve them. Corporations are sought after because they are powerful, in that they are in a position to make human rights a reality, in their indifference to territory, in the centralisation of Information, technologies and economic, human, and financial means. This alliance is essential to ensure that the system does not lead to a transfer of political choices from Public Authorities to private companies; this alliance leads to systemic efficiency. The result is a new definition of sovereignty as we see it taking shape in the digital space, which is not a particular sector since it is the world that has been digitalised, the climate issue justifying the same new distribution of roles (II).

____

📝read the article (in French)

________

Feb. 9, 2024

Organization of scientific events

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: L. Aynès, M.-A. Frison-Roche, J.-B. Racine and E. Silva-Romero (dir.), L'arbitrage international en renfort de l'obligation de Compliance (International Arbitration in support of the Compliance Obligation), Journal of Regulation & Compliance (JoRC) and Institute of World Business Law of the ICC (Institute), Conseil Économique Social et Environnemental (CESE), Paris, February 9, 2024

____

____

🏗️This symposium takes place in the cycle of symposiums organised by the Journal of Regulation & Compliance (JoRC) and its partners Universities, focusing in 2023-2024 on the general theme of the Compliance Obligation

____

📚The works will then be inserted in the books:

📕L'obligation de Compliance, to be published in the 📚Régulations & Compliance Serie, co-published by the Journal of Regulation & Compliance (JoRC) and Dalloz, published in French.

📘Compliance Obligation, to be published on the 📚Compliance & Regulation Serie, co-published by the Journal of Regulation & Compliance (JoRC) and Dalloz, published in English.

____

► General presentation of the symposium: "Compliance Obligation" appears to be far from International Arbitration if Compliance Law is only understood in terms of binding regulations or even Criminal Law. Arbitration would only have contact with Compliance Obligation in a repulsive way, when a person claims to have enforced a contract before an arbitration court that disregards a compliance prohibition, e.g. corruption or money laundering. It is therefore from a negative angle that the cross-over has taken place.

The fact that Arbitration Law respects the requisite of Criminal Law is nothing new. Moreover, the power of Compliance in its detection and prevention tools, particularly in terms of evidence, no doubt increases the global efficiency.

But Compliance Obligation is based on Monumental Goals, notably linked to global human rights and active ambitions about environment and climate which, particularly in the value chain economy, take the legal form of compliance clauses, or even compliance contracts, or various commitments and plans, which the parties can ask the international arbitrator to enforce. They will do so even more as arbitrators are often the only international, or even global, judges available.

The use they will do of Contract Law, Quasi-Contract Law, Enforcement Law, Tort Law, reinforces Compliance Law in a global dimension.

____

____

► Interviennent :

🎤 Laurent Aynès, emeritus Professor at Paris 1 Panthéon-Sorbonne University, Attorney, Darrois Villey Maillot Brochier (Paris)

🎤 Marie-Anne Frison-Roche, Professor of Regulatory and Compliance Law, Director of the Journal of Regulation & Compliance (JoRC)

🎤 Jean-François Guillemin, former General Secretary of the Bouygues Group

🎤 Christophe Lapp, Attorney, Advant Altana (Paris)

🎤 Jean-Baptiste Racine, Full Professor at Paris Panthéon-Assas University (Paris 2)

🎤 Eduardo Silva-Romero, President of the Institute of World Business Law of the ICC (Institute), Attorney, Wordstone (Paris)

____

🧮Read a detailed presentation of the event below⤵️

Oct. 1, 2023

Thesaurus : Doctrine

► Référence complète : J.-C. Roda, "Les obligations environnementales et numériques pesant sur les entreprises : quelle gestion des risques concurrentiels ?", Revue Lamy de la concurrence, n°131, 1er octobre 2023, actualité 4501.

____

► Résumé de l'article (fait par l'auteur) : "Les entreprises cruciales sont aujourd'hui soumises à des obligations de plus en plus lourdes et qui concernent l'environnement et le numérique. Le franchissement de seuils de « taille » oblige désormais ces acteurs à se plier à la logique de la vigilance et de la compliance. De telles obligations ont un impact concurrentiel, surtout si l'on envisage les choses sous l'angle de la concurrence mondialisée. Comment, dès lors, les entreprises concernées peuvent-elles réagir, pour transformer la contrainte en un nouveau départ ? Celui-ci est-il envisageable ? Faut-il faire acte de résilience ou de résistance ?"

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

Sept. 7, 2023

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

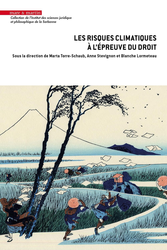

► Full Reference: M.-A. Frison-Roche, "Droit de la compliance et climat. Pour prévenir le risque et construire l'équilibre climatiques" ("Compliance Law and climate. Prevent the climate risk and build the climate balance"), in M. Torre Schaub, A. Stevignon and B. Lormeteau (ed.), Les risques climatiques à l'épreuve du droit, Mare & Martin, coll. "Collection de l'Institut des sciences juridique et philosophique de la Sorbonne", 2023, pp.73-83

____

📝read the article (in French)

____

🚧read the bilingual Working Paper which is the basis of this article, with additional developments, technical references and hyperlinks

____

► Summary of the article: Compliance Law is beginning to emerge in climate topic, through the expression "Climate Compliance Law", but the climate issue itself is the most perfect example of why General Compliance Law is made for. It is indeed a new branch of Law, a global Law claiming to provide Ex Ante solutions here and now for global issues, so that in the future systemic catastrophies will not occur, will not happen: it is these "Monumental Goals" that give meaning, coherence, and simplicity to Compliance Law.

Compliance Law, linked to the Rule of Law principle, makes it possible to go beyond the choice often presented between the effectiveness of the protection of the planet and the renunciation of freedoms, in particular the freedom to do business and the freedom of individuals, especially the protection of their data.

Climate is thus exemplary of the object of Monumental Goals of Compliance Law (I). The systemic risk that it now constitutes is analogous to Banking or Digital Systemic Risks and therefore calls for the application of identical legal Compliance Tools, formerly put in place for Banking Regulatory and Compliance Law, recently invented for Digital. Compliance Law, extending Regulation Law, itself from the precondition of the Sector and the Territory, is therefore the branch which makes it possible to put in place new legal solutions, either by force (judicial agreements, compliance programs, etc.), or by will (commitments, global charters, etc.).

Therefore, an alliance can exist between political and public authorities, and crucial economic operators (II), that the rise in power of the "raison d'être" is the sight and whose technical challenge is the collection of information that must be put in correlation. Scientists pooling Information, this public good, provided by public and private entities. The courts are at the center of this articulation between Compliance Law and Climate, which object is the Future.

________

March 1, 2023

Thesaurus : Doctrine

► Référence complète : J.-Ch. Roda, "Le Digital Markets Act (2e partie). Contraindre les contrôleurs d'accès", Communication - Commerce électronique, n° 3, mars 2023, étude 6

____

► Résumé de l'article (fait par l'auteur) : "Le règlement (UE) 2022/1925 relatif aux marchés contestables et équitables dans le secteur numérique a été adopté le 14 septembre 2022. Mieux connu sous le nom de « Digital Markets Act », ou DMA, c’est un texte très technique, indigeste, de plus d'une soixantaine de pages, et qui doit être complété par des lignes directrices. Il est destiné à « mettre au pas » les grandes plateformes américaines et européennes, en ancrant largement la régulation dans l'ex ante. Incontestablement, il s'agit d'un des dispositifs les plus ambitieux adoptés à l'échelon européen, qui doit permettre d'assurer une meilleur contestabilité sur les marchés numériques, et une plus grande loyauté des comportements. Un texte aussi important appelait un commentaire « grand format ». La première partie de celui-ci, publiée dans le précédent numéro de la revue, s'attachait à cerner l'esprit et l'étendue du contrôle prévu par le DMA. La seconde partie, que nous proposons dans le présent numéro, détaille les obligations auxquelles sont soumis les « gatekeepers », et qui forment le cœur du dispositif.".

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

____

📝consulter une présentation de la première partie de cette étude de Jean-Christophe Roda, "Le Digital Markets Act (1re partie). Contrôler les contrôleurs d’accès"

________

Feb. 1, 2023

Thesaurus : Doctrine

► Référence complète : J.-Ch. Roda, "Le Digital Markets Act (1re partie). Contrôler les contrôleurs d’accès", Communication - Commerce électronique, n° 2, février 2023, étude 4

____

► Résumé de l'article (fait par l'auteur) : "Le règlement (UE) 2022/1925 relatif aux marchés contestables et équitables dans le secteur numérique a été adopté le 14 septembre 2022. Mieux connu sous le nom de « Digital Markets Act », ou DMA, c’est un texte très technique de plus d’une soixantaine de pages. Il est destiné à « mettre au pas » les grandes plateformes américaines et européennes, en ancrant largement la régulation dans l’ex ante. Incontestablement, il s’agit d’un des dispositifs les plus ambitieux adoptés à l’échelon européen, qui doit permettre d’assurer une meilleure contestabilité sur les marchés numériques, et une plus grande loyauté des comportements. Un texte aussi important appelait un commentaire « grand format ». La première partie de celui-ci figure dans le présent numéro de la revue, et s’attache à cerner l’esprit et l’étendue du contrôle prévu par le DMA. La seconde partie, intitulée « Contraindre les contrôleurs d’accès », sera publiée dans le prochain numéro".

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

____

📝consulter une présentation de la première partie de cette étude de Jean-Christophe Roda, "Le Digital Markets Act (2e partie). Contraindre les contrôleurs d'accès"

________

Oct. 5, 2021

Compliance: at the moment

March 10, 2021

Teachings : Banking and Financial Regulatory Law - Semester 2021

Résumé de la dernière leçon : La Compliance, ne serait-ce que par ce terme même, est un mécanisme nouveau dans les systèmes juridiques européens, venant notamment en convergence du Droit de la concurrence, du Droit financier et du Droit du commerce international. L'on considère généralement qu'il provient du Droit financier et du Droit américain, qui développe ainsi d'une façon extraterritoriale ses conceptions juridico-financières.

Est ainsi en train de naître un Droit de la Compliance.

Il pourrait être celui qui disciplinerait l'économie numérique, laquelle croise étroitement l'économie bancaire et financière, qu'elle renouvelle.

Pour en mesurer l'importance et le développement, qui ne font que commencer, le plus probant est de commencer par sa manifestation incontestable en Droit français, à savoir la loi du 9 décembre 2016 de la loi dite "Sapin 2", suivant de peu la loi du 21 juin 2016 sur les abus de marché et suivie de peu par la loi du 27 mars 2017 sur le devoir de vigilance des sociétés donneuses d'ordre.

Revenir aux bases avec le Dictionnaire bilingue du Droit de la Régulation et de la Compliance

Approfondir grâce à la Bibliographie générale du cours de Droit de la Régulation bancaire et financière

Revenir au plan général du cours de Droit de la Régulation bancaire et financière

Revenir à la présentation générale du cours de Droit de la Régulation bancaire et financière

Parcourir les billets quotidiens d'actualité sur la Compliance.

Utiliser les matériaux ci-dessous pour aller plus loin et préparer votre conférence de méthode:

Oct. 15, 2020

Thesaurus : Soft Law

Full reference: Serious Fraud Office, Operational Handbook about Deferred Prosecution Agreements, October 2020

Oct. 9, 2020

Thesaurus : Soft Law

Full reference: Financial Stability Board, The Use of Supervisory and Regulatory Technology by Authorities and Regulated Institutions. Market Developments and Stability Implications, Report of 9th of October 2020, 36 p.

Read the presentation of the report by the Financial Stability Board

To go further on the question of the use of new technologies in regulatory processes, read Marie-Anne Frison-Roche's working paper: Analysis of blockchains with regards with the uses they can fulfill and the functions that the ministerial officers must ensure

Aug. 17, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference: Frison-Roche, M.-A., Risk Mapping: is it legally different when it is made by Regulatory Bodies or by Regulated Enterprises?, in Newsletter MAFR - Law, Compliance, Regulation, 17th of August 2020

Read, by freely subscribing, other news of the Newsletter, MAFR - Law, Compliance, Regulation

Summary of the news

Each year, the Autorité des marchés financiers (French financial markets regulator), the European Central Bank and the Agence française anti-corruption (French anti-corruption agency) publish risk maps. At first glance, risk maps established by the regulator aim to both help regulator and the regulated company to face risks by anticipating them. These documents would only be an assistance brought to firms in their Compliance mission and not an injunction from the regulator to take into account the risks that it emphasizes.

However, Law forces firms to do their own risk maps under penalty of sanctions. Since the regulator has previously published its own risk map, can companies, obliged to write theirs, deviate from it? If the firm follows the map published by the regulator, can it protect itself against this if it is accused of not having fulfilled its compliance obligations? On the contrary, if the operator does not follow regulator's risk map, can this be blamed on it? Formally, regulator's risk maps do not come with an injunction to take it into account but, as everyone knows, any recommendation from a regulator or supervisor must be taken into account.

The legal solution could here be the implementation of a system of "comply or explain" which would mean that if the firm decides to no follow the risk map established by the regulator, it must be able to justify its choice.

To go further, read:

- Frison-Roche, M.-A., Legal Theory of Risk Mapping, center of Compliance Law, working paper, 2020

Aug. 10, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference : Frison-Roche, M.-A., The practical utility to have a firm definition of "Compliance", Newsletter MAFR - Law, Compliance, Regulation, 10th of August 2020.

Read by subscribing the other news in the Newsletter MAFR - Law, Compliance, Regulation

Summary of the news

Some says that defining Compliance is a theoretical and non useful exercice that should be left aside to tackle the study of concrete technical cases. However, to be able to use Compliance tools, it is first necessary to have a clear, firm and simple idea of what is Compliance. Moreover, the future of this new branch of law intensely depends on the definition we choose to use.

Compliance Law gives to some crucial private firms new responsibilities such as the one to fight against global dangers or the one of saving the planet. In this, Compliance Law can be perceived as a kind of new deal between the private sector and public authorities, with the only difference that this time the consent of the private sector is not required.

Some would say that the concretization of such projects is the duty of the State and that private firms, if they must respect the rules, do not have to find a way to concretize a "monumental goal". However, the world face new and systemic dangers in the face of which the State alone is powerless, technically or geographically, and against which crucial companies can act.

It is not about, as some advocate to put human being aside of Compliance Law by letting machines decide. It is about placing the human being and its protection at the heart of Compliance Law. In this, Compliance Law can become a new humanism.

To go further, read Marie-Anne Frison-Roche's working paper, The Dreamed Compliance Law

July 25, 2020

Thesaurus : Doctrine

Full reference: Thouret, T., Le pharmacien, un "opérateur crucial" pour prévenir une crise des opiacés en France, Actu-juridiques, Lextenso, 2020

Lire l'article (in French)

March 23, 2020

Publications

Without any request, on his or her newsfeed, those who surfs on the social network built by Facebook, has found on 23 of March 2020, in the morning, the following message :

« X (prénom de l'internaute), agissez maintenant pour ralentir la propagation du coronavirus (COVID-19) Retrouvez les actualités des autorités sanitaires et institutions publiques, des conseils pour ralentir la propagation du coronavirus et des ressources pour vous et vos proches dans le Centre d’information sur le coronavirus (COVID-19)" ("X (user's name), act now to slow down the spread of the Coronavirus (COVID-19). Find the health authorities and public institutions' news, advices to slow down the spread of the Coronavirus for you and your entourage in the Information Center about Coronavirus (COVID-19) »).

This corresponds to the more general declaration done the same day by Kang-Xing Jin, director of Health at Facebook, who declares : "In response to the coronavirus outbreak, Facebook is supporting the global public health community’s work to keep people safe and informed. Since the World Health Organization declared the coronavirus a public health emergency in January, we’ve taken steps to make sure everyone has access to accurate information, stop misinformation and harmful content, and support global health experts, local governments, businesses and communities.".

Thanks, Facebook to indicate how to do ; by the way, thanks to having invited me to do it. By the way, is it really an « invitation » ? Since the expression is « act now ». Just miss the exclamation point, and the pointed finger of Uncle Sam for « war effort »!footnote-1770.

If in Law, we can consider « invitation », it would be not to the "invitation" that in the past Bank of France did to shareholders banks to refinance a bank which risks to be soon into difficulties that we could consider, invitation from which the invited cannot really escape. No, obviously no, it is just the same message that you and me can write on our Facebook pages to tell similar things about the same purpose ! But, Facebook would be, like you and me, editor of contents ?

Questions and difficulties which encourage to proceed to the legal analysis to know under which title Facebook posted such a message.

The first hypothesis is that this firm has acted spontaneously, following its « Corporate Social Responsibility » (I) If it is the right qualification, with regards to the content of the message, legal consequences are important because this firm, without generalizing to others, by the expression of its care of common good, shows, by transitivity, that it is an editor.

The second hypothesis starts from the observation that Facebook is a « crucial digital operator ». In this perspective, the firm is constraint to Compliance Law (II). It is the reason why, it is constraint by specific obligations, that excludes the spontaneous message emission qualification. If it is the right qualification, with regards to the content of the message, legal consequences are also important and of a totally different nature. Indeed, the qualification leads to develop the relation between the obligation to fight against fake news and malicious websites towards those of redirecting towards public websites, benefiting for the operator of a reliability presumption.

Read the developments below.

Dec. 19, 2019

Interviews

Reference Frison-Roche, M.-A., Le droit de la compliance pour réguler l'internet (Compliance Law to Regulate the Internet), Interview given in French to Sylvie Rozenfeld, Expertises, December 2019, p.385-390.

Summary. Law seems increasingly powerless to stem the social disorder generated by the Internet. For Marie-Anne Frison-Roche, Law professor and specialist in Regulatory Law, the solution is to be found in Law, and more particularly in Compliance Law. This specific Law is already applied in the banking and finance sector, or in the area of personal data. As it has done for green finance and through the GDPR, Europe could impose a compliance system which internalizes concern for the individual in large digital operators. It is up to them to put in place the means and bear the cost, such as the right to be forgotten erected by the CJEU. Marie-Anne Frison-Roche does not offer anything revolutionary, she is content to take elements of positive law that already exist and to correlate them.

Read the interview (in French)

Read the presentation of the official Report for the French Government about which this interview is given:: The contribution of Compliance Law to the Governance of Internet.

Dec. 19, 2019

Publications

Complète Reference : Frison-Roche, M.-A., Théorie juridique de la cartographie des risques, centre du Droit de la Compliance (Legal Theory of Risk Mapping, center of Compliance Law), D.2019, chronique Compliance, p.

Summary : The act of mapping risks is not currently defined by Law. It is only described in special laws. While risks mapping is central to preventing in Ex Ante the occurrence of crises or behaviors from which the occurrence is excluded, no legal regime is available, due to the lack of a legal definition available. This legal definition is proposed here in 5 stages, starting from special laws and specific cases to go towards a general conception. Risk mapping then appears as a concern for others taken care of willingly or by force by crucial operators, through a new subjective right: the “right to be alarmed”, the map being the structural counterpart of the character of the whistleblower. Two articulated systems of Compliance Law.

Read the article, published in French.

Read its translation in English.

_______________

Sept. 27, 2019

Conferences

Generale Reference : Frison-Roche, M.-A., Les solutions offertes par le Droit de la Compliance pour lutter effectivement contre les contrefaçons de masse (The solutions offered by Compliance Law to fight effectively against mass counterfeiting) , in Seminar of the Association des Praticiens du Droit Droit des Marques et des Modèles (APRAM), La contrefaçon de masse : va-t-on un jour réussi à y mettre un frein ? Quelques nouvelles pistes de réflexion (How to stop the mass Counterfeiting?, some new ideas), Paris, September 27, 2019.

Read the program of the Seminar. (in French)

This conference is based on the report given to the French Government and published in July2019 : The contribution of Compliance Law to the Governance of Internet.

It is also based on the new contribution to the new edition of the Grands Arrêts de la propriété intellectuelle : "Le maniement de la propriété intellectuelle comme outil de régulation et de compliance"(in French). This publication is based on this Working Paper : The use of Intellectuel Property as a tool for Regulatory and Compliance Perspectives.

Summary : In this seminar devoted to new ways of reacting to "mass counterfeiting", the idea here is to start from the observation of an increase in the ineffectiveness of intellectual property rights - and thus of the I.P. Law. Law being a practical art, it is not a simple inconvenience, it is a central question. This can be remedied by improving the Ex Post legal process, but we can think of finding Ex Ante mechanisms. The Regulatory Law is Ex Ante, but digital world is not a sector, it is the world itself. A promising direction is therefore Compliance Law, in that it is both Ex Ante and non-sectoral. The contribution shows how Compliance Law is already useful, could be developed and how it could be applied so that these specific rights could be effectively protected in a digital world, where for the moment counterfactors have in fact the means to ignore them.

See the slides. (in French)