Compliance and Regulation Law bilingual Dictionnary

Impartiality is the quality, maybe the virtue, that is demanded of the judge, not only the one who is called like that but also the one who has the function to judge the others (maybe without this name).

It can not be defined as the absolute positive aptitude, namely the total absence of prejudice, the heroic aptitude for a person to totally ignore his or her personal opinions and personal history. This heroic virtue is nonsense because not only is it inaccurate, impossible but it is also not desirable because a person is not a machine. It must not be so because good justice is human justice. In this respect, impartiality refers to a philosophical conception of what is justice and what is Regulation, not machines, but systems that must keep the human person in their center (Sunstein).

Thus Impartiality is articulated with the subjective nature of the assessment not only inevitable but also desirable that the judge makes of situations. Because Law is reasonable, Impartiality is defined only negatively: the absence of bias.

Impartiality is defined first and foremost as a subjective and individual quality, namely, the prohibition on the person who makes a decision affecting the situation of others (as is the case of a judge) to a a personal interest in this situation. The constitutional prohibition of being "judge and party" is thus the expression of the principle of impartiality. This definition is in line with the otherwise general requirement of no conflict of interests.

Impartiality is defined secondly as an objective and individual quality, namely the prohibition for a person who has already known of the case to know again (because he or she has already had an opinion about it, this having constituted an objective pre-judgment).

Impartiality is defined thirdly as an objective and structural quality, which obliges the organ which takes judgments to "give to see" a structure that makes it fit for this impartiality, objective impartiality that third parties can see and which generates confidence in its ability to judge without bias. This theory of English origin has been taken up by European law in the interpretation given to the European Convention on Human Rights. The expression "apparent impartiality" has sometimes given rise to misunderstandings. Indeed, far from being less demanding (in that it is "only" to be satisfied with an appearance of impartiality and not of a true impartiality), it is rather a matter of demanding more, not only of a true impartiality, but also of an impartiality which can be seen by all. This leads in particular to the obligation of transparency, to which the institutions, notably the State, were not necessarily bound by the law.

For a long time the Regulator, in that it took the form of an Administrative Authority, was not considered a jurisdiction, it was long considered that it was not directly subject to this requirement. It is clear from the case law that the national courts now consider that the regulatory authorities are courts "in the European sense", which implies a fundamental procedural guarantee for the operators concerned

The economic theory of incentives implicitly assumes that an operator can not be compelled to act against his will, or at least that it is more efficient to offer him advantages in such a way that he does what he wants . In this, this conception is opposed to the traditional conception of Law, which posits, on the contrary, that subjects obey the order dictated by the legal norm.

But in globalized markets, operators have the tools to disobey and the asymmetry of information diminishes the power of control of the Regulators, which raises doubts as to the effectiveness of the legal constraint: it is not enough that the Law orders. In these circumstances, texts, regulators and judges must produce conditions that encourage agents to adopt behaviors that are consistent with the aims sought by the Regulators because the operators themselves have an interest in them.

Thus, whilst regulatory systems in any sector become increasingly repressive, even in liberal economies, it is not so much to punish the perpetrator but to incite others who are tempted to commit crimes, To abandon them. It is the system of exemplarity. This thought prior to Beccaria participates in the re-feoadization of the Law, demonstrated by Pierre Legendre, associated with the decline of the State and to which the Regulation fully participates. Judgeshave little inclination to handle repression in this way, which creates a clash between Criminal Law and Regulatory Law, which nevertheless puts repression at its center.

In the same way, Regulatory Systems must inject positive incentives, for example rewards for communication of information, which encourages delation, or incentives done by the regulator for the network manager make investments in the maintenance of it, against the immediate interest of its shareholder. Finally, all patent law and economics are now thought of as an incentive to inn/en/article/innovation/ovate. But, some incentives have proven perverse such as stock-options or bonuses. As a result, new texts seek to regulate these.

Independant Administrative Authority (IAA)

The Independent Administrative Authority (IAA) is the legal form that the legislator has most often chosen to build regulatory authorities. The IAA is only its legal form, but French law has attached great importance to it, following the often formalistic tradition of public law. They are thus independent administrative authorities, especially in the legal systems of continental law like France, Germany or Italy.

The essential element is in the last adjective: the "independent" character of the organism. This means that this organ, which is only administrative so has a vocation to be placed in the executive hierarchy, does not obey the Government. In this, regulators have often been presented as free electrons, which posed the problem of their legitimacy, since they could no longer draw upstream in the legitimacy of the Government. This independence also poses the difficulty of their responsibility, the responsibility of the State for their actions, and the accountability of their use of their powers. Moreover, the independence of regulators is sometimes questioned if it is the government that retains the power to appoint the leaders of the regulatory authority. Finally, the budgetary autonomy of the regulator is crucial to ensure its independence, although the authorities having the privilege of benefiting from a budget - which is not included in the LOLF - are very few in number. They are no longer referred to as "independent administrative authorities" but as "Independent Public Authorities", the legislator making a distinction between the two (French Law of 20 January 2017).

The second point concerns the second adjective: that it is an "administrative" body. This corresponds to the traditional idea that regulation is the mechanism by which the State intervenes in the economy, in the image of a kind of deconcentration of ministries, in the Scandinavian model of the agency. If we allow ourselves to be enclosed in this vocabulary, we conclude that this administrative body makes an administrative decision which is the subject of an appeal before a judge. Thus, in the first place, this would be a first instance appeal and not a judgment since the administrative authority is not a court. Secondly, the natural judge of the appeal should be the administrative judge since it is an administrative decision issued by an administrative authority. But in France the Ordinance of 1 December 1986 sur la concurrence et la libéralisation des prix (on competition and price liberalization), because it intended precisely to break the idea of an administered economy in order to impose price freedom on the idea of economic liberalism, required that attacks against the decisions of economic regulators taking the form of IAA are brought before the Court of Appeal of Paris, judicial jurisdiction. Some great authors were even able to conclude that the Paris Court of Appeal had become an administrative court. But today the procedural system has become extremely complex, because according to the IAA and according to the different kinds of decisions adopted, they are subject to an appeal either to the Court of Appeal of Paris or to the Conseil d'État (Council of State) . If one observes the successive laws that modify the system, one finds that after this great position of principle of 1986, the administrative judge gradually takes again its place in the system, in particular in the financial regulation. Is it logical to conclude that we are returning to a spirit of regulation defined as an administrative police and an economy administered by the State?

Finally, the third term is the name itself: "authority". It means in the first place an entity whose power holds before in its "authority". But it marks that it is not a jurisdiction, that it takes unilateral decisions. It was without counting the European Court of Human Rights (ECHR) and the judicial judge! Indeed, Article 6§1 of the European Convention on Human Rights states that everyone has the right to an impartial tribunal in civil and criminal matters. The notion of "criminal matter" does not coincide with the formal traditional concept of criminal law but refers to the broad and concrete factual concept of repression. Thus, by a reasoning which goes backwards, an organization, whatever the qualification that a State has formally conferred on it, which has an activity of repression, acts "in criminal matters". From this alone, in the European sense, it is a "tribunal". This automatically triggers a series of fundamental procedural guarantees for the benefit of the person who is likely to be the subject of a decision on his part. In France, a series of jurisprudence, both of the Cour de cassation (Court of Cassation), the Conseil d'État (Council of State) or the Conseil constitutionnel (Constitutional Council) has confirmed this juridictionnalization of the AAI.

In the traditional scheme, the administration does not need to be independent, since everyone has a sense of the general interest. In the system of regulation, which refers to a theory of suspicion, the regulator must necessarily be independent both from the government and from the operators, because both seek their particular interests (their own utility function).

Independence is defined as the material and psychological condition that allows the beneficiary to decide impartially, that is to say without having to follow orders formulated by a third party, or even be influenced by him. To meet this requirement, the regulator in France takes the form of the Independent Administrative Authority, with conditions for the appointment of members, the functioning of the institution and the allocation of the budget carefully established by Law.

The independence of European regulators is even stronger than in the United States, since they are not part of a check and balance system and as such no one keeps them.

The combination of their power, to which independence contributes, and their irresponsibility have been criticized.

Formally, the legal system had constructed the regulatory authorities in the form of Independent Administrative Authorities (AAI).

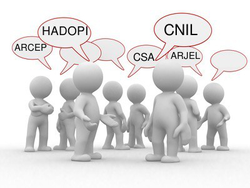

The stake being to build their independence in an institutional and consubstantial way, the Legislator conferred a new status: that of Independent Public Authority (API). Thus, the Autorité des Marchés Financiers (AMF), the Commission Nationale Informatique et Libertés (CNIL), the Haute Autorité de Santé (HAS) or HADOPI are classified among APIs and not only among IAAs.

We must therefore see two distinct legal categories, AAI on the one hand and APIs on the other.

Thus the two laws of January 20, 2017 relate, to better supervise them, both on AAIs and on APIs, but reading the preparatory work shows that the two categories show that they are treated in a fairly common way. Even more if one consults the sites of certain regulatory authorities themselves, such as HADOPI, for example, it presents itself as an "Independent Public Authority" but defines this legal category as being that which targets the Authorities. Independent Administrative .....

It thus appears that the category of Independent Public Authorities is above all marked by the symbol of a greater dignity than that of the category of "simply" Administrative Independent Authorities. From a technical point of view, the two categories are essentially distinguished from a budgetary point of view, financial autonomy being the nerve of independence. This is how the AMF's budget is based on the size of market operations, through tax mechanisms that are not included in the LOLF. Independence does not extend to autonomy, the API does not negotiate its budget with Parliament, since an Independent Public Authority is not a Constitutional Authority.

In a competitive market, information flows spontaneously through the prices that are communicated by sellers on the goods they offer, with demanders inquiring about the quality of the products. Admittedly, it may happen that there is a shortfall through collusion or abuse of a dominant position that disrupts the relevance of this information, which the competition authority will sanction and rectify ex post. But markets can be affected by structural market failure. This is especially so when there is an information asymmetry. In such a case, the regulation and its permanent conductor, the regulator, will capture the information and circulate it.

Information is crucial, especially in financial markets because financial instruments are themselves information about the economic value of the companies that issue them. The regulator must ensure not only that this information is accurately communicated to the market, but also that it is shared among all market players. This is why all financial regulatory systems provide for the sanction of insider trading, whereby the holder of information that he does not share with others (inside information) uses it to obtain information on the market. Benefit that others do not get.

The texts on market abuse, on breaches or insider trading or on the dissemination of false information on the financial markets are increasingly severe because, in a knowledge economy, information is the material of confidence in the financial industry and banks and ensures the dynamism of the system. This justifies that some have gone so far as to see it as a common good, that is to say a value to which everyone can have access. The movement is even more powerful in the area of health, since information on health products and procedures is now a global good because of the dangers of this beneficial and regulated medical activity.

Network industries are built on transport infrastructure such as telecommunications waves or data, gas or electricity, which are essential facilities.

These essential infrastructures are monitored by regulators not only for the operators to have a concrete right of access but also for a complete network of these infrastructures to be built in a space, especially in Europe, for example to achieve a European railway system.

These infrastructures also exist in banking, financial and insurance matters, which it would be futile to oppose too easily to Network industries, as financial centers are based on huge computer systems, internalized clearing houses, which are themselves Infrastructure, deserving Regulation.

In this way, the optimal infrastructure solidity, the Regulator having its final responsibility in a permanent control over the manager, whether the State or an operator - whether the operator is an operator Public or a private operator -, and the competitive dynamism of the sector that the system can also entrust to the same regulator.

This is particularly the case in Financial Regulation, which aims to optimize the places, which compete with each other, and their respective security, which itself constitutes a competitive advantage, common to all operators.

In an ordinary market, goods and services are content to circulate through the interplay of supply and demand. Innovation appears when the supplier chooses to seduce the applicant no longer by offering a lower price, but by putting on the market a different product that is more suited to a need, or even by creating a need, in short, by innovating. Even more innovation occurs through the scientific spirit, which would be "natural", in that it corresponds to the desire to understand the world, a research process which results in discovery, which generates the establishment of a technical object.

But this distinction is undoubtedly over. In fact, with some exceptions, inventions also require colossal financial investments, for example in the pharmaceutical field. If we want there to be innovation, that is to say progress, for example in medicine, operators must be encouraged to invest in R&D, because the taste for knowledge of the 18th century is no longer enough. Incentive regulation to obtain innovation will operate mainly through patent Law, that is to say the attribution of an exclusive right, which contradicts the original pattern of competition. The profitability of the patent encourages companies to risk such research investments. The relationships between competition and intellectual property remain difficult and reflect those existing between competition and regulation.

Institutions de régulation économique et démocratie politique

Institutions de régulation économique et démocratie politique

The insurance sector has always been regulated in that it presents a very high systemic risk, since the economic operators' strength is required for the operation of the sector and the bankruptcy of one of them may weaken or even collapse all. In addition, insurance is the sector in which moral hazard is the highest, since the insured will tend to minimize the risks to which he is exposed in order to pay the lowest premium possible, even though ehe company is engaged to cover an accident whose size can not be measured in advance. Thus, the science of insurance is above all that of probabilities.

The recent challenge of regulating insurance, both institutional, the construction and the powers of the regulator of the sector, and also functional, namely the relations that it must have with the other bodies and institutions, lies mainly in the relationship between the insurance regulator and the bank regulator, which refers to the concept of "interregulation." If the formal criteria are followed, the two sectors are distinct and the regulators must be similarly separated. There was the case in France before 2010. En 2010, considering activities, sensitive to the fact that insurance products, for example life insurance contracts, are mostly financial products, and moreover, through the notion of "bank-insurance", the same companies engage in both economic activities, the solution of an unique body has been chosen.

A part from the fact that in Competition Law companies are defined by market activity, the main consideration is that the risk of contamination and spread is common between insurance sector and banking sector. For this reason, the French Ordinance of 21 January 2010 created the Autorité de Contrôle Prudentiel -ACP (French Prudential Supervisory Authority), which covers both insurance companies and banks, since their soundness must be subject to similar requirements and to an organization common. The law of July 2013 entrusted this Authority with the task of organizing the restructuring of these enterprises, thus becoming the Autorité de Contrôle Prudentiel et de Résolution - ACPR (French Prudential Control and Resolution Authority).

However, the substantive rules are not unified, on the one hand because the insurers are not in favor of such assimilation with banks, secondly because the texts, essentially the European Directive on the insolvency of insurance companies ("Solvency II") , eemain specific to them, and at a distance from the Basel rules applying to banks, which contradict the institutional rapprochement exposed before. European construction reflects the specificity of the insurance sector, the Regulation of 23 November 2010 establishing EIOPA, which is a European quasi-regulator for pension funds, including insurance companies.

The current issue of insurance regulatory system is precisely the European construction. While the Banking Union, the Europe of banking regulation, is being built, the Europe of Insurance Regulation is not being built. Already because, rightly, it does not want to merge into the banking Europe, negotiations of the texts of "Solvency II" stumbling on this question of principle. We find this first truth: in practice, it is the definitions that count. Here: Can an insurance company define itself as a bank like any other?

L'enjeu actuel de la Régulation assurantielle est précisément la construction européenne. Tandis que par l’Union bancaire, l’Europe de la régulation bancaire se construit, l’Europe de la Régulation assurantielle ne se construit. Déjà parce que, à juste titre, elle ne veut pas se fondre dans l’Europe bancaire, les négociations des textes de « Solvabilité II » achoppant sur cette question de principe. L’on retrouve cette vérité première : en pratique, ce sont les définitions qui compte. Ici : une compagnie d’assurance peut-elle se définir comme une banque comme une autre ?

Integration (vertical and horizontal)

The traditional theory of competition assumes atomized agents. Conversely, any large operator, even if this configuration is not prohibited, presents as an anomaly. Even more, if it performs several functions in a value chain, by a "vertical integration", for example at the same time a function of production, transport, distribution and sale, and that it is about a monopoly enterprise, the classical construction is thwarted. This is why the liberalization of sectors has been accompanied by a systematic destruction of the vertical integrations of incumbent operators, for example EDF.

Horizontal integration, for its part, corresponds to the merger of companies that are in the same segment of economic activity and which thus increase their market shares and their power, by playing in particular on economies of scale. Focusing on the assessment criteria for merger control, the question that arises more in regulated sectors is: should a very strong concentration of crucial or systemic operators be allowed to take place?

Indeed, we observe that the banks concentrate it more and more. Likewise, there are only three global rating agencies and four global audit firms. One can consider that the concentration in the regulated systems is a factor of more systemic fragility. On the contrary, it can be argued that in order to perform their "crucial" function these operators must be powerful and, if they are properly supervised, they should be rather concentrated.

Intellectual property is an exclusive right conferred by the right to the author of a work (literary or artistic property) or of a technical invention (industrial property), which allows the latter to prohibit others from duplicating this which it produced without its consent.

This exclusive right thwarts the competitive system, in which copying is ordinary behavior, a form of circulation, of increasing wealth, a situation conducive to innovation. Tensions are therefore strong between competition Law and intellectual property and competition authorities tend to see abuses of a dominant position where, for example, pharmaceutical companies believe that they are claiming the use of their intellectual property rights. Digital technology gives rise to theoretical and practical confrontations of the same magnitude.

But if intellectual property is inserted intellectually into the Regulation, the State no longer grants this exclusive right ex post to reward the author for having created or invented. In a more dynamic and global way, intellectual property is for the State an incentive public policy tool to lead economic agents to innovate with the prospect of receiving the financial fruits increased by the absence of competition for several years.

For example, currently in the field of patents, economists only see them as part of a state-led policy.

It is undoubtedly still different in matters of literary and artistic property which remains with a more romantic vision of an artist whose mainspring is not the lure of gain but the desire for the beautiful and whom it does not suit. to encourage creation. This has undoubtedly affected the prospect of creating industries in the cultural sector. Digital technology is converging the two schemes, perhaps towards the same obsolescence.

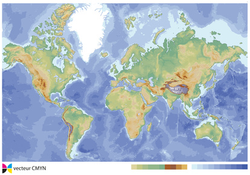

The intensification of the exchanges around the planet is distinguished from globalization in that the first phenomenon refers to the acceleration of economic exchanges without being confused with the disappearance of the space and time of the combined mechanisms of finance and digital, which is expressed by the term "Globalization".

In its strict and classical sense of intensification of exchanges around the globe, globalization ("mondialisation" in French) is not a new phenomenon; it has simply taken on a new dimension: globalization is an intensification of trade in goods and people. It is not a disappearance of circulations, encounters and exchanges, which on the contrary constitutes "globalization,, in the new sense of the term.

Free world trade presupposes that borders can not be opposed to the movement of goods and the World Trade Organization (WTO) has been set up for this purpose, the Marrakesh Accords of 1994 conferring on this organization a very great power , Since two conflicting states have their own disputes settled by a dispute settlement body whose report is endorsed by the WTO itself. The State whose enterprises have been the victim of an illegitimate tariff or non-tariff barrier, can itself inflict retaliatory measures on the guilty state by a kind of private justice. The WTO mechanism is concerned with goods and not with financial mechanisms, which do not even need to remove borders and other barriers, since their immateriality has already destroyed the limits and is thus a matter of "globalization", in the second and new sense of this term.

Globalization, in its strict sense of intensification of exchanges, is thus establishing market law on a global scale, even though this system has not yet become legalized to the point of establishing a global Competition Law as such, since the absence of a barrier to entry is just the first principle of this Law. But there is also no Regulation, that is to say that for the time being, the principle of free adjustment of supply - even foreign suppliers - and the demand of domestic consumers is not in balance with other principles, such as public service, risk prevention, preservation of common goods, etc.

So we are still waiting, not only in the political sense but also in the technical sense, for the establishment of the Regulation of Globalization, in both senses of this term. This is particularly needed in environmental regulation, as the outline of a global environmental organization has not flourished. It is feared that what is called "regulation of globalization", that is to say, such a balance, does not come from the public authorities alone, for lack of a global Public international public order sufficiently powerful and coherent. But it could come from the crucial global operators, through the mechanisms of compliance and social responsibility.

For the benefit of the consumer and the efficiency of systems, networks should cover as large a territory as possible, for example Europe. For this, there must be a mesh between the different networks so that, for example, travelers or electric or electronic waves can pass from one to the other. This capability is referred to as interconnection.

This interconnection is particularly delicate at the borders between countries and that is why regulators often have specific and greater powers with regard to the interoperability of cross-border networks. Thus, to take the example of the European telecommunications agency, set up in 2010, this simple agency has no real regulatory power, more like a simple observatory gathering and disseminating data, except in this regard. which concerns cross-border interconnections.

If there is no interconnection, there cannot be a common system. This can be set up by the standards. A classic example is that taken from the gauge of railway tracks, different between France and Germany, which prohibited the interconnection of the railways of the two countries, to which the standardization of materials and constructions has put a term.

The Internet is a network which first of all allowed computer-connected people to communicate with each other, then to transport not only messages (mails), but also voice, but also images, and finally more generally and abstract: "data". Moreover, the Internet is now referred to as having the base, or even the synonym of "digital".

The Internet is not a market but undoubtedly a mode of communication and distribution of goods (e-commerce) or rather a "space", the digital in which markets are developing, that of online advertising for example, and the phenomenon of platforms which refers to the new notion of a two-sided market and which one seeks to regulate in a possibly specific way.

Indeed, the Internet calls for regulation, even if some would like it to be only the space for the expression of freedoms, even of subjective rights, the right of which would be the right of access. The principle that we must regulate the digital space is particularly due to the fact that it is the site of many illicit activities, for example money laundering or pedophilia. Discussions focus in advance on the modes of regulation, at first sight difficult to imagine due to the very fact of the immateriality of this "virtual" space.

Indeed, information is elusive and circulates in an instant across the entire planet and the avenue often proposed is that of self-regulation by providers of access and content. Public regulation has developed so far intervened on specific issues, for example the protection of intellectual property rights against illegal downloading, entrusted to HADOPI, or the regulation of online games, entrusted to ARJEL) .

The regulation of the internet remains to be done and the fundamental questions are not yet decided, in the very principles, that of the "net neutrality. The disputes focus even more on the question of knowing who could be the" Regulator of " Internet ": the telecoms regulator, the audiovisual regulator, the personal data regulator, or the companies themselves.

The term interoperability refers to the technical ability of tools or machines to articulate with each other, to work together.

This is particularly important in IT, for example between source software and application software, and in finance between market infrastructures. Likewise, the interconnection of networks is a mode of interoperability.

Regulation imposes ex ante the interoperability of techniques, for example by unifying standards, by giving the regulator the power to adopt them and impose them on everyone or by condemning the dominant operator to communicate its know-how to others, interoperability then being a form of right of access. The European Commission condemned Microsoft for abuse of a dominant position to give its source codes to its competitors wishing to develop application software which shows that, as for essential facilities, the ex post of the judicial handling of competition law can have the same effects as the ex ante handling of regulatory law.

Regulation has arisen from the need to take account of the specific nature of the sectors, often accompanied by their liberalization.

But, first of all, goods from different sectors can be substitutable. Thus, both gas and electricity can be heated, as intermodal competition makes the segmentation of regulation of the electricity sector and regulation of the gas sector less relevant to the idea of a single sector of "energy", which nevertheless allows the regulation of water and oil out of its grip. Similarly, a life insurance contract is both an instrument of protection for the future, a product that is therefore covered by insurance Regulation, but also a financial product placed with consumers by banking-insurance companies, objet to the banking regulatory control. This intimacy of regulation with respect to the internal technicality of the object on which it bears can not be erased.

The interregulation that will take place is initially institutional. That is why an alternative opens: either the regulatory authorities are merged, and thus the UK's Financial Services Authority (FSA) has merged financial and banking regulation in 2000, what has not done the French system. Thus, the first branch of the alternative is the institutional fusion, at the risk of constituting kinds of titans, or even reconstituting the State. Either procedures for consultation and joint work are established to create contact points, or even a common doctrine among regulators, as it is between ESMA, EBA and EIOPA in the UE regulatory mechanisms.

The other branch of the alternative is to respect this initial relationship between regulation and the sector and to take note of the links between sectors through the proposed concept of "interregulation". This involves setting up networks between autonomous authorities, but exchanging information, meeting, collaborating on common issues, and so on. This interregulation may initially be horizontal when authorities from several sectors collaborate, for example, ESMA, EBA and EIOPA. It may also be vertical when the authorities of national sectors collaborate with foreign authorities or European or international authorities, as envisaged by the Lamfalussy process in financial matters (extended to the banking and insurance sectors) or the Florence Process in the field of telecommunications or the Madrid Energy Process, where European national regulators meet and work together. This can take more formal institutional forms, such as in telecommunications, with BEREC, or in energy matters with ACER, with and around the European Commission. The comitology technique has generalized this institutional formula.

Interregulation is then notional, a "common law" of regulation developing, common between all sectors. This "common law" (horizontal law) came after the maturity of sectoral regulation laws (vertical laws). It develops in fact because regulated objects are located on the border of several sectors, or even ignore these borders : for example financial derivatives on underlying agricultural or energy. Moreover, "connected objects" generate interregulation in digital space. Thus, even though it is possible that the Internet may give rise to an "interregulation" before giving rise to a specific regulation, the latter can then justify that the first one is dispensed with. That has not happened yet. This regulation of the digital world should be global. It is therefore possible that there remains a mechanism of interregulation.

La régulation est née de la nécessité de prendre en compte la spécificité des secteurs, souvent en accompagnement de la libéralisation de ceux-ci.

Mais, en premier lieu, des biens de différents secteurs peuvent être substituables. Ainsi, l’on peut se chauffer aussi bien au gaz qu’à l’électricité, la concurrence intermodale rendant moins pertinente la segmentation de la régulation du secteur de l’électricité et la régulation du secteur du gaz. Pareillement, un contrat d’assurance-vie est à la fois un instrument de protection pour l’avenir, un produit relevant donc de la régulation assurantielle, mais aussi produit financier placé auprès des consommateurs par des entreprises de banque-assurance, relevant donc de la régulation bancaire et financière. Cette intimité de la régulation par rapport à la technicité interne de l’objet sur lequel elle porte ne peut être effacée.

L'interrégulation qui va se mettre en place est d'abord institutionnelle. C’est pourquoi, une alternative s’ouvre : soit on fusionne les autorités, et ainsi la Grande Bretagne par la Financial Services Authority (FSA) a, dès 2000, fusionné la régulation financière et bancaire, ce que la France n’a pas fait (tandis que la France a fusionné la régulation des assurances et la régulation bancaire à travers l’ACPR). Ainsi, la première branche de l’alternative est la fusion institutionnelle, au risque de constituer des sortes de Titans, voire de reconstituer l’État. Soit on établit des procédures de consultation et de travaux communes, pour faire naître des points de contact, voire une base de doctrine commune contre les régulateur. L’autre branche de l’alternative consiste à respecter ce rapport initial entre régulation et secteur et de prendre acte des liens entre les secteurs à travers la notion proposée de « inter-régulation ». Cela suppose alors de mettre en place des réseaux entre des autorités demeurées autonomes, mais qui s’échangent des informations, se rencontrent, collaborent sur des dossiers communs, etc. Cette interrégulation peut d’abord être horizontale lorsque des autorités de plusieurs secteurs collaborent, par exemple l’autorité de contrôle prudentiel et l’autorité des marchés financiers, ou l’ARCEP et le CSA. Elle peut être aussi de type vertical lorsque les autorités de secteurs nationaux collaborent avec des autorités étrangères ou des autorités européennes ou internationales, comme le prévoit le processus Lamfalussy en matière financière (élargi aux secteurs de la banque et des assurances) ou le processus de Madrid en matière énergétique par lesquels chaque régulateur nationaux se rencontrent et travaillent en commun, avec et autour de la Commission européenne (technique de la comitologie).

L'interrégulation qui est ensuite notionnelle, un "droit commun" de la régulation s'élaborant, commun entre tous les secteurs. Ce "droit commun" (droit horizontal) est venu après la maturation des droits sectoriels de la régulation (droits verticaux). Il s'élabore de fait parce que les objets régulés se situent à la frontière de plusieurs secteurs, voire ignorent celle-ci : par exemple les produits financiers dérivés sur sous-jacent agricole ou énergétique. Plus encore, les "objets collectés" engendrent de l'interrégulation dans l'espace numérique. Ainsi, alors même qu'il est possible qu'Internet, donne lieu à une "interrégulation" avant de donner lieu à une régulation spécifique, celle-ci pouvant justifier que l'on se passe de la première.