Compliance and Regulation Law bilingual Dictionnary

Regulation has arisen from the need to take account of the specific nature of the sectors, often accompanied by their liberalization.

But, first of all, goods from different sectors can be substitutable. Thus, both gas and electricity can be heated, as intermodal competition makes the segmentation of regulation of the electricity sector and regulation of the gas sector less relevant to the idea of a single sector of "energy", which nevertheless allows the regulation of water and oil out of its grip. Similarly, a life insurance contract is both an instrument of protection for the future, a product that is therefore covered by insurance Regulation, but also a financial product placed with consumers by banking-insurance companies, objet to the banking regulatory control. This intimacy of regulation with respect to the internal technicality of the object on which it bears can not be erased.

The interregulation that will take place is initially institutional. That is why an alternative opens: either the regulatory authorities are merged, and thus the UK's Financial Services Authority (FSA) has merged financial and banking regulation in 2000, what has not done the French system. Thus, the first branch of the alternative is the institutional fusion, at the risk of constituting kinds of titans, or even reconstituting the State. Either procedures for consultation and joint work are established to create contact points, or even a common doctrine among regulators, as it is between ESMA, EBA and EIOPA in the UE regulatory mechanisms.

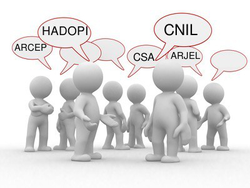

The other branch of the alternative is to respect this initial relationship between regulation and the sector and to take note of the links between sectors through the proposed concept of "interregulation". This involves setting up networks between autonomous authorities, but exchanging information, meeting, collaborating on common issues, and so on. This interregulation may initially be horizontal when authorities from several sectors collaborate, for example, ESMA, EBA and EIOPA. It may also be vertical when the authorities of national sectors collaborate with foreign authorities or European or international authorities, as envisaged by the Lamfalussy process in financial matters (extended to the banking and insurance sectors) or the Florence Process in the field of telecommunications or the Madrid Energy Process, where European national regulators meet and work together. This can take more formal institutional forms, such as in telecommunications, with BEREC, or in energy matters with ACER, with and around the European Commission. The comitology technique has generalized this institutional formula.

Interregulation is then notional, a "common law" of regulation developing, common between all sectors. This "common law" (horizontal law) came after the maturity of sectoral regulation laws (vertical laws). It develops in fact because regulated objects are located on the border of several sectors, or even ignore these borders : for example financial derivatives on underlying agricultural or energy. Moreover, "connected objects" generate interregulation in digital space. Thus, even though it is possible that the Internet may give rise to an "interregulation" before giving rise to a specific regulation, the latter can then justify that the first one is dispensed with. That has not happened yet. This regulation of the digital world should be global. It is therefore possible that there remains a mechanism of interregulation.

Compliance and Regulation Law bilingual Dictionnary

A monopoly refers to the power of a person to remove from a good its utility by excluding others. The monopoly refers to a situation on the market, the monopolist being the sole operator in the market. Lawyers are accustomed to the monopoly conferred by Law, for example the one that was the monopoly for the national public enterprise for electricity. In this case, what is done may be defeated, and the legislature may withdraw that privilege especially if the author of this norm is better placed in the hierarchy of norms than the previous author. For example, the European Union legislature withdrew the legal monopolies by means of directives from most of the operators holding them in the regulated sectors in order to liberalize them.

But the monopoly can have an economic source. Indeed, it may happen that a first operator constructs a structure, for example a wired telecommunications transport network. Because he is alone, agents on the market must resort to him to carry their communications, his business will be profitable. But from there, if a second operator built such an infrastructure, it would inevitably be in deficit for insufficient applicants. This is why no rational economic agent will build a second network. Thus, this network will remain unique. It is then an economically acquired monopoly that the legislative will can not change its nature. That is why it is called "natural".

Since what is can not be changed, Community law has taken note of the monopolistic nature of the majority of networks and the correlated power of their owner or manager, but has correlatively provided for their supervision by a regulator who not only Ex post to resolve possible differences between the infrastructure manager, the natural essential facility, and the one who wants to access it, but also, through an Ex ante power, to negotiate with that manager the return on his capital, his commitments investment in the network, etc., or even more directly by imposing on it the way in which it fixes access tariffs and so on.

These economically natural monopolies are therefore more powerful than legal monopolies, which States and lawyers have taken a long time to understand, but this also explains the reverse tendency of economists to write laws, The texts must handle this type of notions, its writers caring little about the political order and legal notions. The fact that the laws and regulations on regulated situations and supervised operators have long been elaborated solely from the point of view of lawyers, particularly of the public service, which was regrettable, does not justify this passage from one extreme to the other.

Compliance and Regulation Law bilingual Dictionnary

L’Autorité de Régulation des Communication Electroniques et de la Poste (ARCEP) est une Autorité Administrative Indépendante (AAI). Elle a succédé en 2005 à l’Autorité de Régulation des Télécommunications (ART), laquelle fut créée en 1996. L’ART fût la première autorité de régulation du genre, inaugurée sous l’impulsion du la vague de libéralisation des secteurs naguère en monopole .

L’ARCEP a une compétence plus vaste de celle de l’ART, régulant également les activités postales et a pour office de favoriser l’exercice d’une « concurrence effective et loyale au bénéfice des utilisateurs », ce qui la rapproche singulièrement de l’office général de l’Autorité de Concurrence. Ce régulateur doit encore tenir compte de l’ « intérêt des territoires » et de l’accès des utilisateurs aux services et aux équipements. L’ARCEP a compétence pour réguler ce qui transporte les informations (contenant) tandis que le a compétence pour réguler les informations transportées (contenu). Cette distinction contenant/contenu fonde donc la dualité des régulateurs. Mais en premier lieu elle est fragile et peu utilisée à l’étranger, d’autres pays préférant avoir un seul régulateur pour le contenant et pour le contenu, dans la mesure où les informations peuvent passer par divers contenants (par ex. télévision ou le téléphone). En second lieu Internet rend difficile le maniement de cette distinction. C’est pourquoi on évoque parfois l’hypothèse de fusion des deux autorités de régulation.

L’ARCEP surveille les marchés de gros, dans lesquels les opérateurs doivent se comporter d’une façon transparente, non discriminatoire et publier une offre de référence. Il les prix et oblige à une orientation du tarif vers le coût, favorisant en aval c'est-à-dire (marché du détail) le dynamisme concurrentiel. Sur celui-ci, le régulateur veille à de transport et au réseau de distribution jusqu’au final (problématique de la . L’ARCEP a le pouvoir d’attribuer les fréquences aux opérateurs, lesquelles sont des et dont l’attribution peut être retirée à l’opérateur en cas de . Mais au-delà de ces dimensions très techniques, le régulateur exerce une fonction parce qu’il projette dans le une certaine conception qu’il a du secteur. Ainsi il peut estimer ou non que la fibre optique doit être ou non favorisée et contraindre les opérateurs en ce sens. De la même façon, il peut adhérer à la théorie de la « » au nom de laquelle il va imposer aux propriétaires d’un réseau de l’ouvrir à des utilisateurs, même au prix d’investissements pour les accueillir, le régulateur fixant alors l’indemnisation d’un tel . L’adhésion à cette théorie, très discutée, n’est pas de nature technique mais politique.

L’ARCEP dispose du pouvoir précité de retirer des fréquences aux opérateurs ne remplissant pas leurs obligations et peut prendre des mesures conservatoires. Celles-ci peuvent être attaquées devant la Cour d’appel de Paris. L’autorité exerce un pouvoir deet d’un pouvoir de . L’ARCEP publie un rapport annuel, façon pour l’Autorité de , ce mode de étant mis en balance avec son .

Comme en 1996 pour les télécommunications, à partir de 2005 le régulateur a ouvert à la les activités , tout en veillant à la poursuite du postal. La Loi du 9 février 2010, tout en transformant la Poste en société anonyme a veillé à maintenir ses obligations de service public et les a même étendues en lui confiant des obligations d’aménagement du , montrant avec la régulation . Par ce contrôle, le régulateur exerce un pouvoir plus que technique.

Compliance and Regulation Law bilingual Dictionnary

"Network industry": this is an expression easily used to designate economic activities which involve a "transport network", which includes telecommunications (which carries voice, images, "data"), railways ( which carries cars, people, goods), electricity (which carries electrons), post office (which carries letters, packages), highways (on which cars and trucks run), etc.

It is also customary for them to oppose banking, finance and insurance activities, which develop in businesses (banks, insurance companies) or in places (financial markets).

This presentation, however usual it may be, is not very happy in that it opposes the two types of activity. This "opposition" undoubtedly corresponds more to the fact that the first economic activities are traditionally governed by public Law because they were the fruit of public enterprises under the supervision of the State and the control of the Conseil d'Etat, while the second activities economic, because the issuers of securities or insurance contracts are private companies, are subject to private Law and control by the judicial jurisdiction.

Indeed and in reality, financial centers, like networks, constitute essential facilities and banking regulation resembles energy regulation in many ways, both centered on risk. Having thus given way to the autonomous concept of network industries at this point is in practice harmful, in particular by the fragmentation of knowledge and jurisdictional skills.

Even more, the development of digital technology, which today constitutes a global space perhaps synonymous with "globalization", sweeps away this distinction because digital technology only develops with the support of a network (the web) and in this space all activities take place. deploying, in particular banking and finance, while the question of data becomes a primary issue there, data no longer being the prerogative of "network industries".

Compliance and Regulation Law bilingual Dictionnary

We must give a strict definition of globalization. Globalization isn't simply the intensification of economic exchanges through the lowering of borders and the rapidity of trade, a phenomenon known since antiquity and of which the World Trade Organization (WTO) is today the guardian. Globalization aims at a radically new phenomenon, that of economic exchanges without any constraint of time or place, dealing with goods without corporality since it is information. This is the case for all personal data, all information and all finance (because financial instruments can be analyzed as information), which through technology flows out of space and in an instant. In what can be called "real virtuality", states and law do not know how to grasp normatively this new reality, because until now they had only apprehended palpable objects in spaces enclosed by their borders . Globalization, therefore, is a radical change the world, that has radically changed the game.

Compliance and Regulation Law bilingual Dictionnary

Compliance and Regulation Law bilingual Dictionnary

The United States established regulatory authorities at the end of the 19th century: starting from the principle of the market, they tempered it by setting up regulators, after noting market failures, for example in terms of transport, in the event of economically natural monopolies or essential facilities. The tradition of the European Union is the reverse since the States, in particular the French State, have considered that sectors of general interest, deemed unsuitable for the competitive pattern because not corresponding to the operational pattern of the meeting of supply and demand, and to serve the missions of public services, were to be held by the State, either directly by public establishments, or by public enterprises under the supervision of the ministries.

Evolution in Europe came from community Law. Indeed, after the Second World War, the idea was to build a market which was to be "common" to European countries so that they could no longer wage war on each other in the future. To achieve this goal, the borders between them were lifted thanks to the principles of free movement of people, goods and capital. In the same way, the defense by each of the States of its own national companies by State aid has been prohibited so that any company, even foreign, can enter its territory, so that a common internal market can be established. Finally, a competition Law was necessary to prohibit companies and States from hindering the free functioning of the market, which would have slowed down or even stopped the construction of this internal market, which was an essentially political goal of the Treaty of Rome.

To carry out this political goal, the European Commission and the Court of Justice of the European Union (CJEU, previously called the Court of Justice of the European Communities - CJEC - until the Treaty of Lisbon) have prohibited any behavior of agreement or of abuse of a dominant position, even on the part of public enterprises, as well as any state support (except in the event of a crisis). Likewise, in perfect political logic, but also in perfect contradiction with European national traditions, European texts, regulations or directives have liberalized previously monopolistic sectors, first of all telecommunications and then energy. This was the case for telecommunications with the 1993 directive, the 1996 directive for electricity and the 1998 directive for gas.

Because of the hierarchy of standards, the States, except to be sued before the Court of Justice by the European Commission in action for failure, were obliged to transpose by national laws these European texts. Thus, by force, community law, both through general competition Law, but above all to achieve its political goal of building a single and initially peaceful internal market, has triggered in Europe a system of economic regulation in all network industry sectors, a system which was nonetheless foreign to the culture of the Member States. This was not the case with banking and insurance regulations, sectors which have always been threatened by systemic risk, and as such have been regulated and supervised by national central banks for a very long time.

Community Law has for 30 years plunged into national Law while ignoring them, which could also be profitable, and on the basis of competition Law, the political dimension of the European project having been forgotten, no doubt over time as the War itself faded from people's minds.

The effects of globalization and the financial crisis have constituted a new turning point in Community Law which, since 2010, has been built no longer to modify national Laws - and destroy them in part - but to build a new Community Law which should neither to Competition Law nor to National Law: Community Regulation Law, which makes room for individual rights and attempts to build over time a system that is robust to crises. Thus, by texts of the European Union of 2014, both a Banking Union and a new Law on Market Abuse is being built, which aims to establish a common law for the integrity of financial markets.

One of the challenges is what could or should be reconciliation between the two Europe, an economic and still not very social Europe on the one hand and the Europe of Human Rights, which is based on the European Convention on Rights of Man. This is not on the agenda.

Compliance and Regulation Law bilingual Dictionnary

These essential infrastructures are monitored by regulators not only for the operators to have a concrete right of access but also for a complete network of these infrastructures to be built in a space, especially in Europe, for example to achieve a European railway system.

These infrastructures also exist in banking, financial and insurance matters, which it would be futile to oppose too easily to Network industries, as financial centers are based on huge computer systems, internalized clearing houses, which are themselves Infrastructure, deserving Regulation.

In this way, the optimal infrastructure solidity, the Regulator having its final responsibility in a permanent control over the manager, whether the State or an operator - whether the operator is an operator Public or a private operator -, and the competitive dynamism of the sector that the system can also entrust to the same regulator.

This is particularly the case in Financial Regulation, which aims to optimize the places, which compete with each other, and their respective security, which itself constitutes a competitive advantage, common to all operators.

Compliance and Regulation Law bilingual Dictionnary

Self-regulation refers to a system capable of defining its equilibrium by its own forces or, if there is a dysfunction in it, to restore them equally by its own forces. Self-regulation refers to a system capable of defining its equilibrium by its own forces or, if there is a dysfunction in it, to restore them equally by its own forces. Thus, the competitive market for ordinary goods and services is self-regulated. Indeed, since there are no barriers to entry and there is information on products and prices, coupled with mobility of atomized consumers, consumers permanently make functioning competition between offers, this elaborating the right price. If an agent fixes an abusive high price, a third party outside the market will enter it to offer consumers a lower price, the new entrant coveting that rent, and consumers, by nature unfaithful, thus changing supplier. Essential is therefore free trade, the absence of a barrier to entry and the absence of eviction from one undertaking to another, eviction being the most serious anticompetitive practice. Thus, competition law is based on the premise of a self-regulated market. In these circumstances, it is only on a case-by-case basis that anti-competitive conducts, agreements and abuses of dominant position can be found. They are then sanctioned ex post by the competition authority which, by appropriate sanctions, somehow "repairs" the market.

Today we live at the same time a certain despair in front of the pretension of the self-regulation ethics, because the banks pretended to do it and the information brought by the financial crisis lead to take some distance in relation to this moral discourse, while that at the same time we are called to a renewal of this moral sense in business and in capitalism. Social responsibility can constitute this renewal.

Finally, self-regulation can be sociological when a sector is composed of people who know each other, whether they work in companies, in the administration or in the regulatory body. The case is all the more widespread because it corresponds to the organization of the network society. This is actually a self-regulation by club effect. The danger of this self-regulation is no longer at the risk of a moralizing discourse that is more a matter of marketing, but of an almost unconscious compromise of the regulator, thus captured by habit or friendship. The regulatory system must also seek to break this self-regulation, which is dangerous for the impartiality of the regulator.

Compliance and Regulation Law bilingual Dictionnary

The procedural guarantees from which the person benefits are mainly the right of action, the rights of defense and the benefit of the adversarial principle.

While the rights of the defense are subjective rights which are advantages given to the person at risk of having his situation affected by the decision that the body which is formally or functionally legally qualified as a "tribunal", may take, the adversarial principle is rather a principle of organization of the procedure, from which the person can benefit.

This principle, as the term indicates, is - as are the rights of the defense - of such a nature as to generate all the technical mechanisms which serve it, including in the silence of the texts, imply a broad interpretation of these.

The adversarial principle implies that the debate between all the arguments, in particular all the possible interpretations, is possible. It is exceptionally and justified, for example because of urgency or a justified requirement of secrecy (professional secrecy, secrecy of private life, industrial secrecy, defense secrecy, etc.) that the adversarial mechanism is ruled out. , sometimes only for a time (technique of deferred litigation by the admission of the procedure on request).

This participation in the debate must be fully possible for the debater, in particular access to the file, knowledge of the existence of the instance, the intelligibility of the terms of the debate, not only the facts, but also the language (translator, lawyer , intelligibility of the subject), but still discussion on the applicable legal rules). So when the court automatically comes under the rules of Law, it must submit them to adversarial debate before possibly applying them.

The application of the adversarial principle often crosses the rights of the defense, but in that it is linked to the notion of debate, it develops all the more as the procedure is of the adversarial type.

Compliance and Regulation Law bilingual Dictionnary

Europe is a political project.

This project was conceived at the end of the second world war with the aim of never having a war between the European countries. For this Jean Monnet had the idea of building an economic market as the first step, the second step being a political government. This second stage remains to be established today, since the European Constitution has failed.

Europe is therefore in the middle of the ford since Community law has built the three freedoms of movement and competition law, but we have no economic policy or market governance. Thus, for none of the regulated sectors of the European regulator, many say, for example, the need for a European banking and financial regulator. The financial crisis that the United States exported to Europe has generated the secondary benefit of laying the foundations of the European banking Union and coordination of financial markets is being put in place.

But historically, Europe has exercised its power and weight on the Member States by its own Competition Law and the principle of freedom of movement and installation without associating or replacing it with European regulatory perpective or that the Member States can effectively oppose their traditional system of centralized regulation, for example, through the mechanism of State control over public monopolistic enterprises.

Moreover, in a movement perceived at first as a great aggression but more in line with the prospect of building a "Europe of Regulation", through the directives of liberalization, first of all concerning telecommunications, then Electricity, and then gas, in energy or telecommunications, Europe has imposed on States the guidelines for the new regulatory systems, which continue to remain national. It was spontaneously that the National Regulators were in each of the sectors networked to exchange information, to increase their effectiveness. As long as Europe can not establish an economic government, because there will not be a political Europe, it will be difficult to argue that there is a Europe of Regulation, insofar as regulation is a triangle between economics, law and politics, and the latter is most often lacking at European level, for example in the technological choices to be made in the sectors.

The movement has historically been very differently in finance. It did not come from Europe, but from the United States and did not take a binding form. Countries, notably France, wanted to gain the confidence of foreign investors, decided in the late 1960s to opt for models of independent regulators: the "Commission des Opérations de Bourse -COB" was designed on the American model of the Securities and Exchanges Commission -SEC".

Only in the aftermath of the financial crisis, itself of banking origin, did Europe appear in these sectors. Europe is in the making. It is based on the European Central Bank (ECB). This evolution can produce a rebalancing of institutions and subjects, with the ECB coming in balance with the European Commission, which remains focused on Competition Law.

But there are "two Europes". The first, described above, is "economic" or of the "political economy." The second is the Europe of Human Rights, constructed by the same catastrophe constituted by the Second World War on the European Convention on Human Rights. Human Rights (ECHR). They are articulated closely, but sometimes with difficulty, in the Law of Regulation.

Compliance and Regulation Law bilingual Dictionnary

In a competitive market, information flows spontaneously through the prices that are communicated by sellers on the goods they offer, with demanders inquiring about the quality of the products. Admittedly, it may happen that there is a shortfall through collusion or abuse of a dominant position that disrupts the relevance of this information, which the competition authority will sanction and rectify ex post. But markets can be affected by structural market failure. This is especially so when there is an information asymmetry. In such a case, the regulation and its permanent conductor, the regulator, will capture the information and circulate it.

Information is crucial, especially in financial markets because financial instruments are themselves information about the economic value of the companies that issue them. The regulator must ensure not only that this information is accurately communicated to the market, but also that it is shared among all market players. This is why all financial regulatory systems provide for the sanction of insider trading, whereby the holder of information that he does not share with others (inside information) uses it to obtain information on the market. Benefit that others do not get.

The texts on market abuse, on breaches or insider trading or on the dissemination of false information on the financial markets are increasingly severe because, in a knowledge economy, information is the material of confidence in the financial industry and banks and ensures the dynamism of the system. This justifies that some have gone so far as to see it as a common good, that is to say a value to which everyone can have access. The movement is even more powerful in the area of health, since information on health products and procedures is now a global good because of the dangers of this beneficial and regulated medical activity.

Compliance and Regulation Law bilingual Dictionnary

The concept of 'Agency', sometimes confused with the one of 'Regulator', designates a way of deconcentrating the State. Away from a French Jacobin outlook, states have indeed gradually devolved their sovereign responsibilities to other institutions, which are often geographically distant from the state's political capital city. These agencies are a form of technical decentralization because they are in charge of operational tasks and specific expertise, e.g., as regards employment, environment or health issues. This model, which is very common in Scandinavian countries, is often associated with federal structures, like in the United States. It is still fairly remote to the French model that remains to this day built on the idea of a centralized and unified State. So far, France has only developed a few agencies (e.g., France Trésor, tasked with managing France's government debt and cash positions).

In a different perspective, although the two notions are homonyms, the American financial theory developed the notion of 'agency' to describe the relationship between the corporate officer (the agent) and the shareholder (the principal), who empowers the first to act on his behalf to serve his interest. Information asymmetry and conflict of interest mark this relationship, which explains that this theory helped developing multiple safeguards, conveyed by the Financial Regulation.

Compliance and Regulation Law bilingual Dictionnary

Criminal law is a very special branch of law.

While it expresses in the highest degree the "legitimate monopoly of State violence”, which cannot develop beyond the borders because it is intimate to the regalian power, and should in this respect be governed by Public Law, it is traditionally inserted in Private Law. This is due to the fact that Criminal Law is conceived as a legitimate exception to the liberty of persons (to act as they wish - to which the criminal prohibitions are opposed - to come and go - Imprisonment contravenes). The judicial judge in so far as he is constitutionally the guarantor of the freedom of persons is therefore the natural criminal judge.

Criminal Law can therefore be applied only through the office of the judge, which is inseparable from criminal proceedings, whereas other substantive branchs of law (Civil Law, administrative Law, Commercial Law, etc.) applies apart from the corresponding procedure (civil procedure, administrative litigation, commercial procedure, etc.), or even to apply without trial.

Because it is an exception, Criminal Law is constitutionally limited, by the principle of legality of offenses and penalties, of by the principle ot strict interpretation, of interpretation in favorem. Because it has a logic of its own, it constitutes within the legal system a branch of the so-called "autonomous" law, which does not take account of other branches. Moreover, it takes precedence over them, the criminal decisions having absolute authority, the criminal holding the civilian in a state.

But economic law, and even more the regulatory law, has completely challenged this powerful classical conception.

Indeed, the teleological Regulatory Law aims at achieving its goal: to balance the principle of competition and other concerns, such as access to common goods or the prevention of systemic risks.

In this very dynamic and systemic conception, law is only an instrument. It is sought only in its ability to produce the desired effect. The criminal law then both enhanced and will fall from its pedestal.

Indeed, sanctioning power, including fines and prohibitions, is considered the necessary and ordinary core of what must be effective regulatory system. Thus the laws increased the amounts incurred.

But because the issue is effectiveness with regard to the goals, Criminal Law becoming an instrument, it thus loses its autonomy. Its interpretation is made in the light of the other rules which it ensures the effectiveness, rules of Public Law, Company Law, Civil Law, system of proofs, etc. Moreover, because it must be effective, its interpretation ceases to be strict: teleology often involves a broad interpretation.

Its intimacy with the State dissolves and the emergence of a criminal law from the markets imposes itself, whose contours follow the markets themselves. Thus, the repression of market abuse is organized on a European scale and most often a decal of American Law. Global Criminal Law is being put in place. It applies outside the trial, notably through the transaction or settlement, which flows the criminal law into the contract. To apply more broadly, the evidence changes in nature, admits presumptions

Criminal law is dissolved in the law of repression, which is better conceived in a repressive administrative rules, applying objectively to breaches. The passage from one to the other, the cohabitation of one with the other, is done with difficulty, as shown in the European saga Non bis in idem.

Whatever the country, constitutional courts, whose office is to defend the rights and freedoms of individuals, tend to defend the classical conception of Criminal Law, while regulators tend to defend the regulatory conception of the objective sanction of failures.

Compliance and Regulation Law bilingual Dictionnary

Accounting is a kind of photography of the "value" of the company, of its heritage, balancing its assets and liabilities but also integrating its past activity but possibly its future activity. Accounting, an information tool, becomes a tool not only for the manager, the shareholder, the co-contractors, but also for the present or future investor, that is to say the market.

Classical accounting, of German origin, valued the company's assets at their historical cost (for example the purchase price of goods), but the new accounting standards, under British influence and through the proposals of the International Accounting Standards Board (IASB), wanted to bring together the notion of value and that of the market. Indeed, a property has a value corresponding to the price that a potential buyer will give it and not to the price that its current owner has paid to acquire or control it. This notion of fair value or market value has led to the valuation of assets at their net asset value. We have therefore come closer to more exact prices, in line with the very notion of competitive prices but also extremely variable with the markets, the financial markets themselves being disconnected from the real economy by speculation. As a result, weakening markets weakened balance sheets and a domino effect playing between balance sheets and markets, especially with regard to banks, greatly contributed to the 2008 financial crisis. However, while financial activity did not cannot be thought of apart from an accountancy playing a central role in the information and in the confidence of the investors, the basis of the current accountancy, inseparable from the regulation of the banking and financial market, has not been replaced for the moment.

Compliance and Regulation Law bilingual Dictionnary

The airline industry was the first regulated sector in the 1920s This reflects the fact that air transport implies that people can travel from one state to another state, which justified an early multilateral system of international agreements between States , under public international law, each retaining its share of sovereignty and its national company (eg. British Airways).

But the principle of competition making the organization more complex through the mechanisms of open sky that allow an airline company to offer its services abroad, regulation must be more open to competition.

In addition, the regulation of air cares more risks by adopting global safety standards to be imposed on all operators in the conduct and maintenance procedures of the equipment.

Compliance and Regulation Law bilingual Dictionnary

The Independent Administrative Authority (IAA) is the legal form that the legislator has most often chosen to build regulatory authorities. The IAA is only its legal form, but French law has attached great importance to it, following the often formalistic tradition of public law. They are thus independent administrative authorities, especially in the legal systems of continental law like France, Germany or Italy.

The essential element is in the last adjective: the "independent" character of the organism. This means that this organ, which is only administrative so has a vocation to be placed in the executive hierarchy, does not obey the Government. In this, regulators have often been presented as free electrons, which posed the problem of their legitimacy, since they could no longer draw upstream in the legitimacy of the Government. This independence also poses the difficulty of their responsibility, the responsibility of the State for their actions, and the accountability of their use of their powers. Moreover, the independence of regulators is sometimes questioned if it is the government that retains the power to appoint the leaders of the regulatory authority. Finally, the budgetary autonomy of the regulator is crucial to ensure its independence, although the authorities having the privilege of benefiting from a budget - which is not included in the LOLF - are very few in number. They are no longer referred to as "independent administrative authorities" but as "Independent Public Authorities", the legislator making a distinction between the two (French Law of 20 January 2017).

The second point concerns the second adjective: that it is an "administrative" body. This corresponds to the traditional idea that regulation is the mechanism by which the State intervenes in the economy, in the image of a kind of deconcentration of ministries, in the Scandinavian model of the agency. If we allow ourselves to be enclosed in this vocabulary, we conclude that this administrative body makes an administrative decision which is the subject of an appeal before a judge. Thus, in the first place, this would be a first instance appeal and not a judgment since the administrative authority is not a court. Secondly, the natural judge of the appeal should be the administrative judge since it is an administrative decision issued by an administrative authority. But in France the Ordinance of 1 December 1986 sur la concurrence et la libéralisation des prix (on competition and price liberalization), because it intended precisely to break the idea of an administered economy in order to impose price freedom on the idea of economic liberalism, required that attacks against the decisions of economic regulators taking the form of IAA are brought before the Court of Appeal of Paris, judicial jurisdiction. Some great authors were even able to conclude that the Paris Court of Appeal had become an administrative court. But today the procedural system has become extremely complex, because according to the IAA and according to the different kinds of decisions adopted, they are subject to an appeal either to the Court of Appeal of Paris or to the Conseil d'État (Council of State) . If one observes the successive laws that modify the system, one finds that after this great position of principle of 1986, the administrative judge gradually takes again its place in the system, in particular in the financial regulation. Is it logical to conclude that we are returning to a spirit of regulation defined as an administrative police and an economy administered by the State?

Finally, the third term is the name itself: "authority". It means in the first place an entity whose power holds before in its "authority". But it marks that it is not a jurisdiction, that it takes unilateral decisions. It was without counting the European Court of Human Rights (ECHR) and the judicial judge! Indeed, Article 6§1 of the European Convention on Human Rights states that everyone has the right to an impartial tribunal in civil and criminal matters. The notion of "criminal matter" does not coincide with the formal traditional concept of criminal law but refers to the broad and concrete factual concept of repression. Thus, by a reasoning which goes backwards, an organization, whatever the qualification that a State has formally conferred on it, which has an activity of repression, acts "in criminal matters". From this alone, in the European sense, it is a "tribunal". This automatically triggers a series of fundamental procedural guarantees for the benefit of the person who is likely to be the subject of a decision on his part. In France, a series of jurisprudence, both of the Cour de cassation (Court of Cassation), the Conseil d'État (Council of State) or the Conseil constitutionnel (Constitutional Council) has confirmed this juridictionnalization of the AAI.

Compliance and Regulation Law bilingual Dictionnary

But this division is fading because the contract is an effective tool because it makes gained acceptance recipient of the norm, becoming the preferred instrument of public policy. The Regulator will use it the more so as on the one hand by the contract operators bring him information and on the other hand, operators have the power to disobey him. That is why the contract is a major figure in the Regulatory system.

The self-regulation mechanism goes further, since the Regulatory system itself is built on contractual commitments, exempting exogenous rules and regulator.

Compliance and Regulation Law bilingual Dictionnary

The Ex Ante, the usual expression in Economic vocabulary, corresponds to the more traditional expression in Law of A priori, and refers to the apprehension of a situation before it is constituted. For example, a law or a regulation is an ex ante act, which will regulate situations after the adoption of the text, of the decision or general disposition adopted by an authority. There is no retroactivity. Conversely, Ex Post, the usual expression in Economics and which corresponds in Law to the A posteriori, refers to a reaction of an organism to a situation or a behavior observed. Thus all individual decisions on sanctions, or all dispute or mediation settlements, come under ex post. For example, judicial acts fall under ex post.

Competition Law is usually recognized in that it develops in the ex post, since the market is established and the competition authority reacts to anti-competitive practices, which may be sanctioned, ie in ex post . Conversely, because it is a question of building competition or of maintaining non-natural balances on a permanent basis in sectors, Regulation Law uses tools that could be called "blank pages", essentially regulations, that is to say ex ante. This explains why the English term of "regulation" express at the same time the regulatory system as a whole and the texts adopted, the regulations (in French "réglementation"), because this ex ante tool is so important, is to intimate with regulatory spirit and perfectly expresses this ex ante distinguishing Regulation Law from Competition Law.

This opposition is fundamental because it not only sheds light on the distinction between competition and regulatory system, but also dictates the distribution and scope of powers. Indeed, to simply react ex post, it is enough to have a power to punish, to order reparations, to decide the different. Ex-ante intervention requires much greater powers since the regulatory authority dictates behavior in order to build markets and sectors. This magnitude of ex-ante powers explains that the title of regulator is so envied, and that even competition authorities sometimes present themselves as regulators of competition, as if constructing them beyond defending them, in particular by the adoption of provisional measures. Confusion is often made or even maintained by the oxymoron of "competitive regulatory system" made by these Competition Authorities, even if they are not limited to a specific sector.

This shows the fragility of the distinction between ex ante and ex post. Indeed, it may be open to criticism that competition authorities seek to appropriate ex-ante powers to exercise them on all markets, even though these markets do not justify the exercise of regulatory mechanism, but it is true that it exists a continuum between ex ante and ex post. This continuum is exercised in both directions. In the sense of the ex-ante to the ex-post, it is the Regulator himself who, after having taken the ex ante standards, ensures its effectiveness through continuous monitoring and sanctioning failures.

Moreover, in the sense of the ex-post to the ex-ante, because, as gaming theory shows, especially in the banking and financial markets, agents are anticipatory, a decision to sanction or to settle different is interpreted as a signal, for example of severity or warning, of tendency, a kind of act of doctrine of authority, that the operators have integrated into their future behaviors. Thus, the ex post act becomes the cognitive ex ante.

Compliance and Regulation Law bilingual Dictionnary

In the traditional scheme, the administration does not need to be independent, since everyone has a sense of the general interest. In the system of regulation, which refers to a theory of suspicion, the regulator must necessarily be independent both from the government and from the operators, because both seek their particular interests (their own utility function).

Independence is defined as the material and psychological condition that allows the beneficiary to decide impartially, that is to say without having to follow orders formulated by a third party, or even be influenced by him. To meet this requirement, the regulator in France takes the form of the Independent Administrative Authority, with conditions for the appointment of members, the functioning of the institution and the allocation of the budget carefully established by Law.

The independence of European regulators is even stronger than in the United States, since they are not part of a check and balance system and as such no one keeps them.

The combination of their power, to which independence contributes, and their irresponsibility have been criticized.

Compliance and Regulation Law bilingual Dictionnary

In Europe, Community Law prohibits States from providing aid to companies, which are analyzed as means for the benefit of their country which the State cares about (and sometimes wrongly) having the effect and maybe the object of maintaining or constructing borders between peoples, thus contradicting the first European political project of a common area of peace and exchanges between the peoples of Europe. That is why this prohibition does not exist in the United States, since Antitrust Law is not intended to build such a space, which is already available to businesses and people.

This essential difference between the two zones changes industrial policies because the US federal Government can help sectors where Member States can not. The European prohibition of State Aid can not be called into question because it is associated with the political project of Europe. This seems to be an aporia since Europe is handicapped against the United States.

In any form it takes, Aid is prohibited because it distorts equality of opportunity in competition between operators in the markets and constitutes a fundamental obstacle to the construction of a unified European internal market. On the basis of this simple principle, a branch of technical and specific law has developed, because States continue to support their entreprises and sectors, and many rules and cases divide this principe of prohibition into as many exceptions and nuances. Is built over the years a probation system related to it. Thus, the concept of a public enterprise was able to remain despite this principle of prohibition.

But if there is a crisis of such a nature or magnitude that the market does not succeed by its own forces to overcome and / or the European Union itself pursues a-competitive objectives, exogenous Regulation, which can then take the form of legitimate State Aid. Thus a sort of synonymy exists between State Aid and Regulation.

For this reason, the European institutions have asserted that State Aid becomes lawful when it intervenes either in strategic sectors, such as energy production in which the State must retain its power over assets, or the defense sector. Far from diminishing, this hypothesis is increasing. European Union Law also allows the State to intervene by lending to financial operators threatened with default or already failing, the State whose function is to fight systemic risk, directly or through its Central Bank. The aid can come from the European Central Bank itself helping States in issuing sovereign debt, the Court of Justice having admitted in 2015 the non-conventional monetary policy programs compliance with the treaties. In 2010, the European Commissioner for Competition stressed that public aid is essential tools for States to deal with crises, before regulations come to the fore in 2014 to lay the foundations of the European Banking Union.

Compliance and Regulation Law bilingual Dictionnary

The environment expresses the concern that man has henceforth of nature, either in itself, or because in destroying it he destroys himself. The interests are thus crossed and cumulated: nature is protected in itself, for him and for the generations to come.

A branch of law was born, "Environmental Law", of which it can not be said whether it belongs to public or private law. It was until recently conceived as an administrative police, based on declarations, authorizations, classifications of the activities generating pollution, and organization of the treatment of waste. We are in the process of switching to environmental regulation, as shown by the new texts of European law, designed by the European Commission that link energy regulation and environmental regulation.

In the long term, it is a question of planning and organizing a healthy environment, thanks to renewable energies, not so much on the basis of constraints or one-off interventions but rather on the basis of incentives and market mechanisms such as CO2 quotas (allocation of quotas to companies by the state and then emergence of prices by meeting the supply and demand thanks to the market), this construction of long-term equilibria on and from the market being itself the sign of regulation.

The "environmental concern" has also been established with financial regulation, in two ways. In the first place, financial techniques are a means of developing tools for the environment, as are the CO2 markets, but also the specific obligations of what would be an environmental compliance for listed companies. Financial regulators of new missions. In the second place, environmental issues are themselves financialized, as if they identify new risks and reveal new uncertainties: as such, the Banking and Financial Regulators appreciate them.

Compliance and Regulation Law bilingual Dictionnary

The distinction between "Public Law" and "Private Law" is important. In the systems of Continental Law, or still called under Roman-Germanic Law, or even called Civil Law systems, it is even around it that legal systems are built: it can be a basic distinction, a summa divisio, as it it in the Civil Law systems. In the so-called Common Law or Anglo-American systems, the distinction is less fundamental, but it remains, justifying in particular that the rules and disputes concerning the administration call for special rules and are apprehended by special tribunals.

In principle, this distinction is based on the nature of the persons whose legal situation is examined. Under"Public Law" a legal situation involving a person who is itself a public-law entity: the State, a local authority, a public undertaking, etc. That is why, for example, the contract which may be concluded will be of public law, and the judge who may be seized of it will be an administrative court. If the situation does not involve a person governed by public law, then it will be governed by "Private Law". There are a thousand exceptions, but this is the starting and basic and fondamental principle.

Two essential remarks, bearing a system of values, explaining that the systems of Civil Law and Common Law are in fact confronting each other.

The two bodies of rules and institutions are not of equal strength because one of the categories is "closed", corresponding to one criterion (the "public person"), while the other is open: Public Law is a closed category; on the contrary, Private law becomes "active" as soon as there is no public person (a "private person" who or which must define himself or itself as a "non-public person").

One can consider this articulation between Public Law and Private Law in two ways, radically opposed. It may express a mark of inferiority in disfavour of private law: we are all "ordinary" persons in "ordinary" situations with "ordinary" activities (this will be the French conception ....). On the contrary, Public Law is the mark of the State, of Public Order, of Sovereignty, of public power, of the general will, in the interstices of which individuals slip in to act and satisfy their small particular interests

On the contrary, Private Law can be considered as the expression of the "common law": people are free and do what they want, through ownership and contract. As an exception and because they have elected people to do so, the rulers (whom they control), by exception, enact norms that constrain them. But this is an exception, since repression - public law and criminal law, which has the same status in this respect - is only a tribute to the freedom of persons, since this freedom remains wholly in the form of the private enterprise on the market.

It is then measured that the articulation between Public and Private Law profoundly reflects a philosophy and a political position. If it is considered that Regulation is the underlying order by which the Sovereign allows the deployment of his subjects who also benefit from a long-term policy constructed by the autonomous and measured political will, then Public Law in Is the master, the Regulation Law expressing a renewed search for efficiency, this but only this. If we believe that Regulation is whereby economic rationality manages to protect persons and companies from risks and to compensate for market failures, a market whose liberal principle remains the ideal, then Private Law is the core, whith contract and private property as basis tools.

France and the Latin countries adhere rather to this metaphysics of values which entrusts to the Public Authorities and the State the legitimacy and the power to express the general interest by Public Law, Regulators and Constitutional Courts, expressing it on a technical form renewed by the Regulatory tools: incitations, soft law, etc. The legal systems whose history draws on British history put more trust in the person of the entrepreneur and conceive of Regulation Law as an efficient outsourcing of functions to administrations that are efficient, informed and impartial.

Certainly, in the technical daily of the Law of Regulation and following the different sectors, Public and Private Law mix up: public companies take the form of publicly traded companies under private law or private companies will be entrusted with missions of public service, instituting them as second-level regulators as are the infrastructure network operators.

But the fundamental conception of systems (rooted in the history of the people) and practice marry. In the silence of regulations (and the more they are gossiping and the more the judge must interpret them, which amounts to a "silence"), what sense to give to the system?

To take only a few questions, frequent in practice:

- What judge to seize? The administrative judge or the civil judge? What is the "natural judge" of the Regulatory Law?

- What standard to apply? The contractual will? The implicit will of the legislator? What is the "natural author" of the Law of Regulation?

- Does the silence of the text prohibit action for operators or on the contrary does silence mean their freedom to act?

The absence of a firm and shared definition of what is the Law of Regulation does not facilitate practice. Hesitations in translations from one language to another increase confusion.

For the time being, there is a tendency to refer to Public Law in the sectors where whe take precedence over public operators' monopolies, such as telecommunications, energy, railways, air and postal services, and to refer to Private Law in the sectors which have long been the subject of competition between operators, namely banking, finance and insurance.

It should be recognized that the criterion of distinction has little economic rationale. The notion of risk would be a clearer and more manageable criterion. But it would then lead to a greater challenge to the distinction between Public and Private Law. Because the Law of Regulation, impregnated with Economy and Economic Analysis of Law, has sometimes little basis of legal tradition, it put in question of this summa divisio. If this were to be the case, it would be the totality of the legal systems which would be upset, especially in its judicial organization, since the judicial civil and commercial system is so distinctly distinguished (that of "ordinary" persons, that of "common law ) and the administrative judge (the "natural judge" of the State). It is then realized that the Law of Regulation challenges the whole Law, especially in the Latin countries and the Civil Law systems.

Compliance and Regulation Law bilingual Dictionnary

But in globalized markets, operators have the tools to disobey and the asymmetry of information diminishes the power of control of the Regulators, which raises doubts as to the effectiveness of the legal constraint: it is not enough that the Law orders. In these circumstances, texts, regulators and judges must produce conditions that encourage agents to adopt behaviors that are consistent with the aims sought by the Regulators because the operators themselves have an interest in them.

Thus, whilst regulatory systems in any sector become increasingly repressive, even in liberal economies, it is not so much to punish the perpetrator but to incite others who are tempted to commit crimes, To abandon them. It is the system of exemplarity. This thought prior to Beccaria participates in the re-feoadization of the Law, demonstrated by Pierre Legendre, associated with the decline of the State and to which the Regulation fully participates. Judgeshave little inclination to handle repression in this way, which creates a clash between Criminal Law and Regulatory Law, which nevertheless puts repression at its center.

In the same way, Regulatory Systems must inject positive incentives, for example rewards for communication of information, which encourages delation, or incentives done by the regulator for the network manager make investments in the maintenance of it, against the immediate interest of its shareholder. Finally, all patent law and economics are now thought of as an incentive to inn/en/article/innovation/ovate. But, some incentives have proven perverse such as stock-options or bonuses. As a result, new texts seek to regulate these.

Compliance and Regulation Law bilingual Dictionnary

Article 6 of the European Convention on Human Rights (ECHR) states that everyone has the right to an impartial tribunal.

Insofar as the regulator in France is most often an Independent Administration Authority (IAA) and this is assimilated to a court, the regulator is required to comply with the ECHR. This contributes to the jurisdictionalization of regulation.

Thus, when there is a sanction or dispute settlement procedure, a real trial is established, and companies, helped by their lawyers, must benefit from access to the file, from the adversarial principle, from rights defense, the right to participate in the debate at the hearing. These fundamental procedural guarantees also include the obligation for the regulator to justify its decisions, which facilitates the control exercised over it by the appeal courts, and to create by accumulation of decisions a sort of case law of the regulators themselves. .

Thus, human rights by procedure have entered the regulatory authorities. This refers to one of the issues that is emerging, namely the balance that must be established between the laws of the market and the non-economic prerogatives of individuals.