participation in a Round-Table

🎥Adéquation et inadéquation de la sanction comme outil de régulation financière et sa transformation par la Compliance (Adequacy and inadequacy of sanctions as a tool of Financial Regulation and its transformation through Compliance), in🧮Quel rôle pour la sanction dans la régulation ? (what role for the Sanction in the Financial Regulatory System?)

ComplianceTech®️. pour lire cette présentation en français ↗️ cliquer sur le drapeau français

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the VideoNews MAFR Surplomb

🌐subscribe to the Newsletter MaFR Law & Art

____

► Full reference: M.-A. Frison-Roche, "Adéquation et inadéquation de la sanction comme outil de régulation financière et sa transformation par la Compliance" (Adequacy and inadequacy of sanctions as a tool of Financial Regulation and its transformation through Compliance)", contribution to the round-table discussion on"Quel rôle pour la sanction dans la régulation ? (What role for sanctions in Regulatory System)", Annual conference of the Commission des sanctions (Enforcement Committee) of the Autorité des marchés financiers - AMF (French Financial Markets Authority), Paris, 14 October 2025.

____

► see the general programme of this manifestation (in French)

The event comprises two round tables. The theme of the first round table is: La preuve des abus de marché entre l’AMF et le juge pénal : vers une convergence ? (Proof of market abuse between the AMF and the criminal courts: towards convergence?)

🪑🪑🪑AutresOther participants in this 2nd round table, moderated by Sophie Schiller, member of the Enforcement Committe on the topic: Quel rôle pour la sanction dans la régulation ? (What role for sanctions in Regulatory System?)

🕴🏻Sébastien Raspiller, Secretary General of the AMF

🕴🏻Martine Samuelian, Partner, Jeantet Law Firm

🕴🏻Vincent Villette, Secretary General of the CNIL (French Personal Data Regulatory Body)

____

► Summary of this intervention : In the round-table discussion on the role of sanctions, a number of contributions will be made, depending on the nature of the discussion itself. They will be brief in nature and will be aimed at an audience with a good knowledge of financial regulation.

It is the occasion for me to insist on 2 things, the first naturely and probably for ever attached to the role of sanctions in all Regulatory Systems, the secund very new. The first is the indissociability between Criminal Law and Sanction, even if sanctions is defined as a regulatory tools. The secund is the conception and the use of sanctions through Compliance Law.

Therefore, in the first idea, my first intervention, aimed more at establishing the subject and describing the Intangible, is on the very idea that sanctions have a role to play in financial regulation. By its very nature. But this does not make it any less difficult. It is not obvious, because if penalties are seen as a 'regulatory tool', then it is the regulatory perspective that predominates and 'colours' the tool that is the penalty. Regulation, of which the texts on the basis which sanctions are issued are only one tool and which is not the set of applicable rules, Regulation which is an apparatus of institutions, rules and decisions aimed at establishing the equilibrium of a sector and maintaining this equilibrium, which is by nature unstable, over time, which the sector could not do by its own efforts alone (Regulatory Law, which is Ex Ante Law, thus distinguishing itself from Competition Law, which is Ex Post Law).

From the perspective of Financial Regulatory System, as in other sectoral regulatory systems, and in the general Regulatory Law, sanctions are a tool (and a tool like any other, simply more powerful than the others.

This is the pragmatic perspective adopted by the State and the Regulatory body itself, which will use it in conjunction with other tools, such as an Information, Education and Incentive mechanism. Moreover, it shall use sanction as informative tool, as educational tool, as incentive tool.

However, the principle of the autonomy of Criminal Law, and the European concept of "Criminal Matters" mean that the sanction can be seen in terms of the autonomous criteria of the seriousness of the act imputed and the sanction imposed on the legal person. In this respect, the penalty is inseparable from the way in which it is imposed (Criminal Law is constitutionally inseparable from Criminal Procedure).

In this respect, the sanction is not a tool coloured by the overall objective served by the Financial Markets Regulatory Body: the sustainability of the financial system. The Enforcement Committee is not the AMF's "armed wing"; it is a "court", as the Oury ruling reminded us.

Therefore, the question is and I would like to ask it directly to the Enforcement Committed: Can you be both?

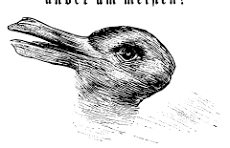

As they say, could you be both carp and rabbit? Depending on whether you are viewed from one angle or another, you will be seen as the body that makes financial markets effective (a tool among the tools) or as the body that punishes misconduct (a court among the courts).

It is possible, and in practice it is often true.

But if we are honest, we will admit that regulation feeds on information and that the procedure before a criminal court is built on secrecy and the weapons of those who, innocent or guilty, are at risk because they are, or will be, prosecuted.

We've never got out of this difficulty. We always try to strike a balance between the fact that it is in itself a repressive sanction for a person who will suffer and the fact that it is also a systemic tool: there is a 'balance' between the search for systemic benefit (which reduces the protection of individuals for the benefit of the system) and the concern for the people involved (which reduces the present and future protection of the system). The balance goes more or less in one direction. It is often public opinion, the place, the legislator and, even above all, the civil appeal judge (vertical dialogue) and those in dialogue, between the regulator and the criminal judge (horizontal dialogue) which cause the scales of diverse technical solutions.

It is also the way in which the Enforcement Committee, in defining itself as the armed wing of the AMF (carp) or as a repressive court (rabbit), chooses in its procedural behaviour the role of sanctions in Financial Regulatory System, more or less instrumentalised (carp) or jurisdictionalised (rabbit).

____

The second point, if there is to be one, concerns the development of the role of sanctions in Financial Regulatory System .

On the basis of these fundamentals, an evolution in the role of sanctions in financial regulatory system (an evolution that can be observed in all sectoral regulatory systems) consists of internalising sanctions (in their conception by the texts, their elaboration by the Sanctions Committees, their application) in the economic operators sanctioned, in the economic sectors concerned, in the opinion concerned (the figure of Peelmanian circles of the audiences applying).

This internalisation transforms Regulatory mission of the administrative body (which deals with market structures) into Rupervision (which deals directly with market operators) since the sanction penetrates the operator, the operator adopting commitments. This concept corresponds to the new branch of Law known as Compliance Law.

Compliance Law uses sanctions as an "incentive like any other", and (we must be careful on this point), because it is systemic in nature, the concern for the system being internalised in the operator, it is relatively insensitive to procedural rights. With the emphasis on information, it is the principle of adversarial debate (which provides information) rather than the rights of the defence that is valued. The cooperation of the person being prosecuted is highly valued, and non-cooperation becomes incomprehensible.

The internalisation of sanctions by operators has led to two major changes. Firstly, these economic operators themselves must sanction, detect and prevent market abuse. The number of special obligations of vigilance is increasing. The obligation of vigilance of operators themselves is becoming a pillar of Regulation, transformed in Supervision.

The other development is the liberalisation of regulatory system in relation to territory, thank to Compliance Law. As operators are less dependent on borders than are regulators and authors of legal texts (but soft law is spreading, including repression), market abuses can be apprehended in several jurisdictions at the same time, notably through global compliance programmes.

________

comments are disabled for this article